Zubair Yaqoob

Karachi

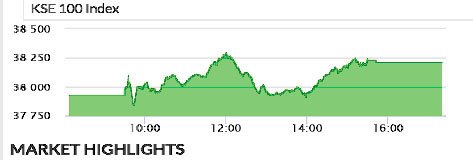

Market was initially expected to face selling pressure in the wake of roll-over week, however, SBP’s status quo on monetary policy instilled confidence among investors believing that the rate cut may be announced early CY2020. Buying activity was observed in Cement (on the back of expectation of posting healthy dispatches). Similarly, Food sector also performed well with majority scrips trading at upper circuits. E&P, OMCs and Refinery remained in the limelight, among which HASCOL maintained the upward trajectory on upper circuit. Cement sector led the volumes with 37.8M shares, followed by Technology (23.7M) and Food (20.5M). Among scrips, PAEL registered 19.1M shares, followed by UNITY (18.6M) and TRG (15M). The Index closed at 38,212pts as against 37,926pts showing an increase of 287pts (+0.8% DoD). Sectors contributing to the performance include Banks (+116pts), Cement (+77pts), Fertilizer (+23pts), Pharma (+20pts) and Technology (+15pts). Volumes declined slightly by 0.8% DoD to 241.2mn shares as against 243mn shares. Average traded value however, increased by 8% to reach US$ 56.4mn as against US$ 52.3mn. Stocks that contributed significantly to the volumes include PAEL, UNITY, TRG, FFL and PSX, which formed 32% of total volumes. Stocks that contributed positively include LUCK (+47pts), MCB (+38pts), HBL (+27pts), UBL (+19pts) and FFC (+18pts). Stocks that contributed negatively include PPL (-26pts), HUBC (-18pts), DAWH (-14pts), SHFA (-7pts), and THALL (-4pts).