Zubair Yaqoob

Karachi

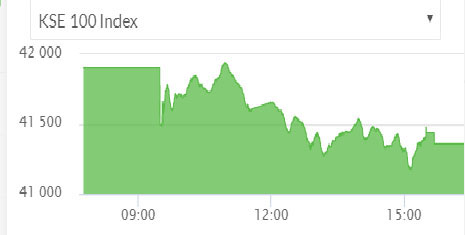

Market took the toll of early morning Iranian strike on Iraqi Military base housing American soldiers. Oil price went haywire with an initial surge towards $72/bbl, but gradually came down as Iranian government signaled an end to confrontation for the time being. Oil & Gas chain bore the brunt of war hysteria and stock prices went down in early trading. Later, as the nerves calm down, market staged a recovery erasing a loss of some 400pts and went positive 35pts. Selling pressure built later during the day and market saw losses piling up -731pts. MoC saw another recovery attempt that ended the session -467pts (unadjusted). Banking sector led the volumes table with 54.9M shares, followed by Power (44.8M) and Cement (26.9M).

Among scrips, KEL traded 39.4M shares, followed by BOP (38.2M) and TRG (11.6M). The Index closed at 41,358pts as against 41,904pts showing a decline of 547pts (-1.3% DoD). Sectors contributing to negatively include Commercial Banks (-148pts), Oil and Gas Exploration Companies (-77pts), Power (-62pts), Fertilizer (-55pts) and O&GMCs (-37pts). Volumes increased from 207.3mn shares to 280mn shares (+35% DoD). Average traded value also increased by 27% to reach US$ 75.4mn as against US$ 59.2mn.

Stocks that contributed significantly to the volumes include KEL, BOP, TRG, MLCF and STPL, which formed 40% of total volumes. Stocks that contributed negatively include HBL (-104pts), PPL (-49pts), HUBC (-42pts), FFC (-37pts) and NBP (-19pts). Stocks that contributed positively include DAWH (+37pts), LUCK (+32pts), and NATF (+11pts).