Zubair Yaqoob

Karachi

News of implementation of Axle Load policy as directed by Islamabad High Court broke the day, post market opening, which had a knee jerk reaction on Cement and Steel stocks. Selling pressure kept building up with investors concerned about growing political wrangling.

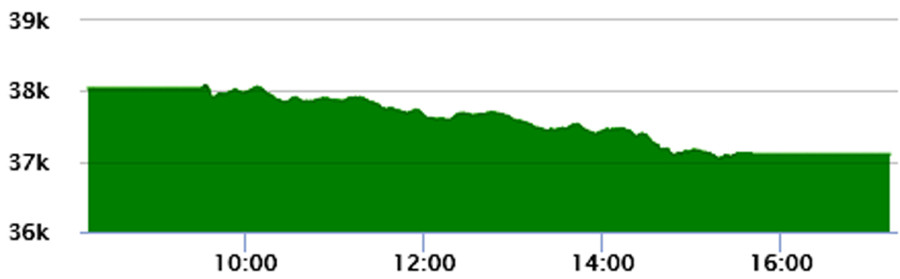

Index heavy weights took the toll, causing index to plunge by more than 1000pts, which caused panic among investors especially after sustaining a blow of 527pts Wednesday.

Cement sector led the volumes table with 42.7M shares, followed by Technology (22.6M) and Engineering (22M). Scrip wise activity showed KEL scoring 12.1M shares, followed by PAEL (10.3M) and TRG (9.5M). The Index closed at 37,101pts as against 38,038pts showing a decline of 936pts (-2.5% DoD). Sectors contributing to the performance include Banks (-208pts), Fertilizer (-114pts), E&P (-100pts), Power (-96pts) and Cement (-95pts). Volumes declined from 327.7mn shares to 232.4mn shares (-29% DoD).

Average traded value also declined by 29% DoD to reach US$ 52.1mn as against US$ 73.5mn. Stocks that contributed significantly to the volumes include KEL, PAEL, TRG, UNITY and BOP, which formed 21% of total volumes. Stocks that contributed positively include NESTLE (+5pts), AICL (+3pts), HASCOL (+2pts), GATM (+1pts) and STJT (+0pts). Stocks that contributed negatively include HUBC (-69pts), ENGRO (-59pts), LUCK (-53pts), PSO (-44pts), and PPL (-43pts).