ZUBAIR YAQOOB

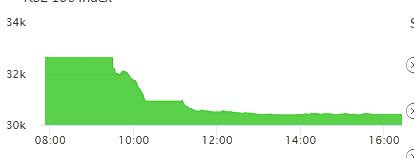

KARACHI First session in lockdown saw a wait-and-see stance at large from investors and an eventual slump in stock prices to lower circuit breakers. The market witnessed the 7th halt, which lasted 2 hours, and further shortened the already reduced market timings. Post halt, index continued trending down and saw the plunge going deeper by the end of session to 2100pts. All hopes of Government ‘incentive’ / ‘bailout’ package for the industry and masses went in vain amid a possibility of country wide lock-down or curfew to be imposed by the Government. A slight rebound in international crude prices kept the interest in E&P stocks alive, resultantly, OGDC, PPL and POL traded above lower circuits. Power sector realized the most trading volume with 27.4M shares, followed by Banks (14.7M) and Vanaspati (11.9M). Among scrips, KEL topped the volume with 25.6M shares, followed by UNITY (11.9M) and BOP (9.6M). The Index closed at 28,564pts as against 30,667pts showing a decline of 2103pts (-6.9% DoD). Sectors contributing to the performance include Banks (-602pts), Fertilizer (- 320pts), E&P (-280pts), Cement (-167pts) and Power (- 150pts). Volumes declined from 245mn shares to 98.3mn shares (-60% DoD).