Zubair Yaqoob

Karachi

Bears continued to dominate trading at the Pakistan bourse for the second successive day on Tuesday. The KSE-100 index was pushed down by 203 points on concerns over the upcoming Financial Action Task Force (FATF) meeting.

Cumulatively, the two-day decline from the bear-run has accumulated to around 800 points.

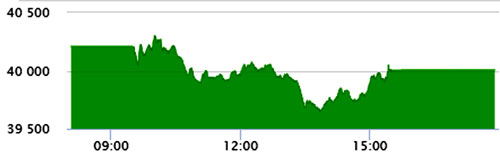

Earlier, trading began with minor ups and downs but still the index managed to post gains during initial hours. After a while, selling pressure surfaced, which dragged the index down by over 550 points.

A buying spree, emerging later in the trading session, helped erase more than half the losses. Despite the selling pressure, the index managed to sustain the 40,000-point mark.

At close, the benchmark KSE-100 index recorded a decrease of 203.14 points, or 0.51%, to settle at 40,006.68 points.

Fauji Fertiliser Company (-0.6%) issued material information, saying its board of directors had recommended subscription of shares of Fauji Fertiliser Bin Qasim (-0.9%) in the rights issue not exceeding Rs2.4 billion for approval of the company’s members. Furthermore, Samba Bank (+12%) in the financial sector touched its upper limit as the Samba Financial Group (SFG) entered into a framework agreement with Saudi Arabia’s National Commercial Bank for beginning a reciprocal due diligence process and negotiating definitive and binding terms of merger.