Zubair Yaqoob

Karachi

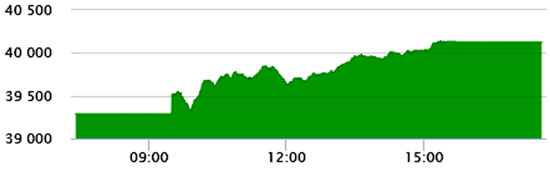

Market finally crossed 40k level today, which was last seen in February 2019. Trading volumes also increased significantly to 557M shares. International Ratings Agency, Moody’s has reportedly upgraded Pakistan’s outlook from Negative to Stable and affirmed B3 rating. This further gave confidence to investors carrying the bull run witnessed from 36K level. Banking sector continued upbeat performance on the bourse with volumes crossing 110M shares, followed by Cement (64.7M) and Power (47M). Among scrips, BOP led the volumes with 74.9M shares, followed by KEL (40.8M) and UNITY (37.7M). The Index closed at 40,124pts as against 39,287pts showing an increase of 837pts (+2.1% DoD). Sectors contributing to the performance include Banks (+516pts), Power (+73pts), O&GMCs (+53pts), Cement (+52pts), Textile (+36pts). Volumes increased significantly from 431.8mn shares to 557.3mn shares (+29% DoD). Average traded value also increased by 14% to reach US$ 106.1mn as against US$ 93.2mn. Stocks that contributed significantly to the volumes include BOP, KEL, UNITY, FFL and PAEL, which formed 34% of total volumes. Stocks that contributed positively include HBL (+119pts), MCB (+92pts), UBL (+89pts), BAHL (+59pts) and HUBC (+51pts).