Ijaz Kakakhel Islamabad

Consumer price index (CPI) jumped 31.5% in February year-on-year, the statistics bureau said on Wednesday, the highest annual rate in nearly 50 years, as prices of food, beverage and transportation surged more than 45%.

Prices were up 4.3% in February from the previous month, the bureau said in a statement. In January, the CPI was up 27.55% year-on-year.

Food and nonalcoholic beverage prices rose by 45.07% over last year. Alcoholic beverages and tobacco prices jumped 47.59% due to an increased tax on cigarettes. In February, the government passed supplementary finance that raised the goods and services tax to 18% from 17% to help raise Rs170 billion rupees in extra revenue for the fiscal year through July.

The government is undertaking belt-tightening, aims to increase revenues through taxes, and has also allowed the rupee to depreciate as it thrashes out a deal with the International Monetary Fund (IMF) to secure more than $1 billion in funding.

In an alarming development, country’s inflation, measured by the consumer price index (CPI), broke all previous records and skyrocketed to 31.5% in February.

The fresh inflation reading issued by the Pakistan Bureau of Statistics (PBS) today has also augmented the prospects of a further rise in interest rates in the upcoming monetary policy committee (MPC) meeting. The inflation rate rushed to 31.5% in February over the year — the highest since the available data i.e. July 1965. Last time, in April 1975, the inflation had been recorded at slightly over 29%.

The pace of increase in the prices beats the expectations of the finance ministry that had just a day ago given a 28% to 30% inflation range. The monthly inflation rate jumped 4.3% in February over January surged due to an increase in the average prices of food items such as poultry, fruits, pulses, oil, vegetables, ghee, LPG, gas charges, and domestic petroleum products.

The inflation reading suggests that the government will have to review its strategy to unlock the critical $1.1 loan tranche from the IMF. The government has not been able to regain any lost ground from the IMF and is giving one after another shock to the people.

The core inflation, calculated after excluding the volatile energy and food prices, also spiralled to 17.1% last month in urban areas and 21.5% in rural areas, signaling price growth is gathering pace across most categories of goods and services.

The inflation rate which has lingered above 20% since June after the coalition government curtailed imports — has been aggravating due to the logjam of containers, the weaker rupee against the dollar, and the tough strategies implemented by the Ishaq Dar-led Ministry of Finance.

The Wholesale Price Index (WPI), which monitors prices in the wholesale market, also rose sharply to 36.4% in February compared to 23.6% in the same month a year ago.

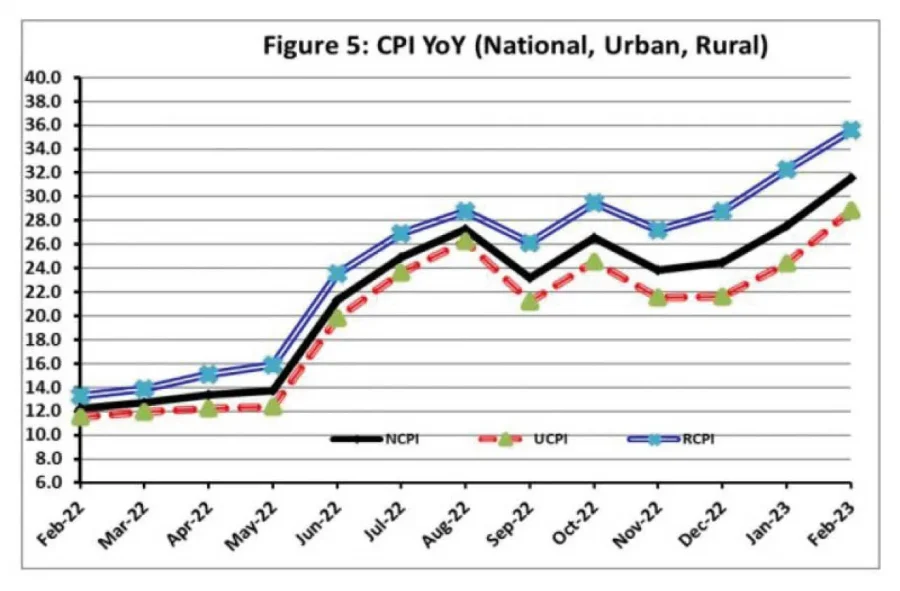

The PBS reported that the overall inflation rate recorded an increase in both the urban and rural areas.

The inflation rate in urban areas surged 28.8% in February and rural areas soared 35.6% over the same month of the last year. In February last year, the inflation rate in urban areas was 11.5% meanwhile, in rural areas it stood at 13.3%.

The food inflation rate in villages and cities soared to 47% and 41.9%, respectively, on a yearly basis. In February 2022, food inflation for villages and cities clocked in at 14.6% and 14.3%, respectively.

The non-food inflation rate was recorded at 20.8% in urban areas and 25.3% in rural areas compared to 9.9% and 12.2% in the same month last year.

The food group saw a price increase of 16.14% in February from the same month a year ago. Within the food group, prices of non-perishable food items surged 2.32% on an annualized basis; meanwhile, the prices of perishable goods surged up by 16.14% year-on-year.

The inflation rate for the housing, water, electricity, gas, and fuel group — having one-fourth weight in the basket — rose by 3.11% (year-on-year) in the last month.

Average prices for the transport group increased by 3.34% in February. Prices related to restaurants and hotels surged 2.36% (year-on-year).