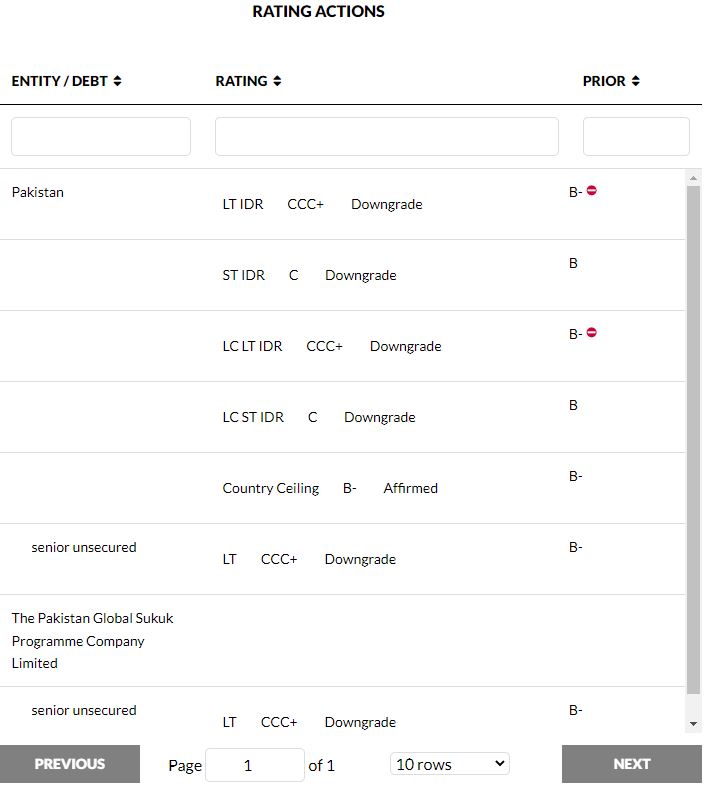

Fitch Ratings has downgraded Pakistan’s long-term foreign-currency issuer default rating (IDR) to “CCC+” from “B-” due to further deterioration in Pakistan’s external liquidity and funding conditions and the decline of foreign exchange reserves.

In its statement on Friday, the agency said that it typically does not assign outlooks to sovereigns with a rating of ‘CCC+’ or below.

According to Fitch, Political volatility, worsening liquidity risks, a risk to IMF deal high inflation, and slow economic growth are some of the significant factors that contributed to the downgrade.

Key factors

Worsening liquidity risks

Fitch said in the statement that the recent floods in Pakistan will undermine Pakistan’s efforts to rein in twin fiscal and current account deficits. Further deterioration in Pakistan’s external liquidity and funding conditions and the decline of foreign exchange (FX) reserves contributed to the downgrade.

Reserves Under Pressure

Referring to the depleting forex reserves of Pakistan, the statement said that the total forex reserves of the State Bank of Pakistan (SBP) were about $7.6 billion by 14 October 2022, enough only to cover about a month of current external payments.

Large Funding Needs

It said that Pakistan’s external public debt maturities in FY23 are over $21 billion, mostly to bilateral and multilateral creditors, which mitigates rollover risks, and there are already agreements to roll over some of these. The authorities estimate the flood damage at $10 billion-30 billion, but reconstruction costs are likely to be lower, as is the impact on Pakistan’s twin deficits.

Risk to IMF program

Fitch assumed that Pakistan will continue to receive disbursements under its IMF program, but risks to this have risen. It said that the fuel-price cuts from Oct. 1 may not be compatible with commitments to the IMF. A quarterly electricity tariff adjustment due in October has yet to happen. The new finance minister has reaffirmed his commitment to the program, but prefers a strong exchange rate and may revisit the SBP law that was amended in early 2022 to grant the SBP greater autonomy, as previously agreed with the IMF, it said.

High Inflation

It further said that the consumer price index (CPI)-inflation averaged 12.2% in FY22 but accelerated to 21.3% YoY (6.3% MoM) in June and averaged 25% YoY (1.8% moM) in July-September, driven by hikes to petrol and electricity prices

Fitch Ratings downgrades Pakistan’s outlook to negative from stable