Zubair Yaqoob

Karachi

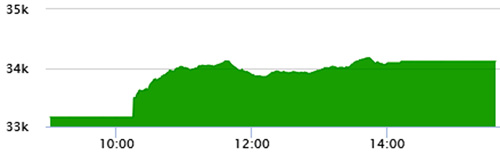

Just before the long weekend, Market went north on Thursday with a jump of 1020pts during the session, closing +953pts, courtesy of rising crude oil prices, expectation of rate cut and relaxation in lockdown.

Activity was observed across the board, with major contribution from oil and gas stocks i.e. E&P, OMCs, with OGDC, PPL and POL hitting upper circuits and realizing high volume trades at that level. Banking sector stocks remained relatively muted, whereas Cement, Fertilizer and Steel sectors made considerable stride forward.

Cement sector topped the chart with 53.6M shares, followed by O&GMCs (45M) and Cable (28.1M). Among scrips, HASCOL ranked first with 37.6M shares, followed by PAEL (26.9M) and MLCF (25.8M). The Index closed at 34,112pts as against 33,159pts showing an increase of 953pts (+2.9% DoD). Sectors contributing to the performance include E&P (+308pts), Banks (+137pts), Power (+94pts), Fertilizer (+87pts) and O&GMCs (+84pts). Volumes increased from 140.5mn shares to 291.5mn shares (+107% DoD).

Average traded value also increased by 61% to reach US$ 76.7mn as against US$ 47.6mn. Stocks that contributed significantly to the volumes include HASCOL, PAEL, MLCF, PPL and UNITY, which formed 42% of total volumes. Stocks that contributed positively to the index include OGDC (+105pts), PPL (+93pts), HUBC (+82pts), POL (+64pts) and MCB (+50pts).