Staff Reporter Karachi

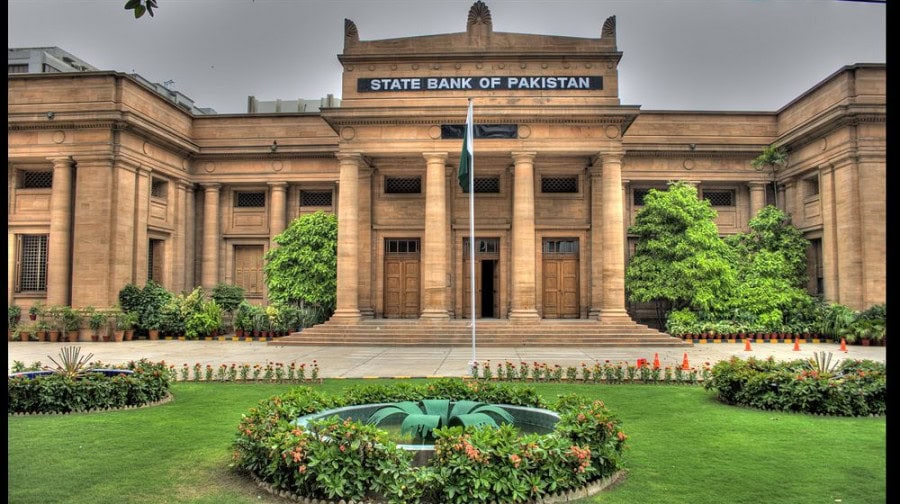

The State Bank of Pakistan held its policy rate unchanged at seven per cent on Friday, citing the need to support financial stability and economic recovery from the Covid-19 pandemic.

The economy has continued to recover and business sentiment has further improved since the last policy announcement in March.

“Since its last meeting in March, the MPC (Monetary Policy Committee) was encouraged by the further upward revision in the FY21 growth forecast to 3.94 per cent,” the bank said in a statement.

The SBP said while inflation had risen since January, a small number of energy and food items accounted for about three-fourths of this rise.

“Demand-side pressures are contained, wage growth is subdued and inflation expectations are reasonably anchored,” the central bank said in a tweet. Inflation rose to 11.1pc last month.

It said the higher growth forecast confirmed the strength of the “broad-based economic rebound underway since the start of the fiscal year, on the back of targeted fiscal measures and aggressive monetary stimulus”.

“This positive momentum is expected to persist, translating into higher growth next year,” it added.

However, the SBP said uncertainty remained due to the third wave of the coronavirus, suggesting the need for the monetary policy to remain supportive.

“The MPC was of the view that the current significantly accommodative stance of monetary policy remains appropriate to ensure the recovery becomes firmly entrenched and self-sustaining.

This is especially so given the renewed heightened uncertainty created by the ongoing third wave of Covid in Pakistan and the fiscal consolidation expected this fiscal year,” it noted in its policy statement.