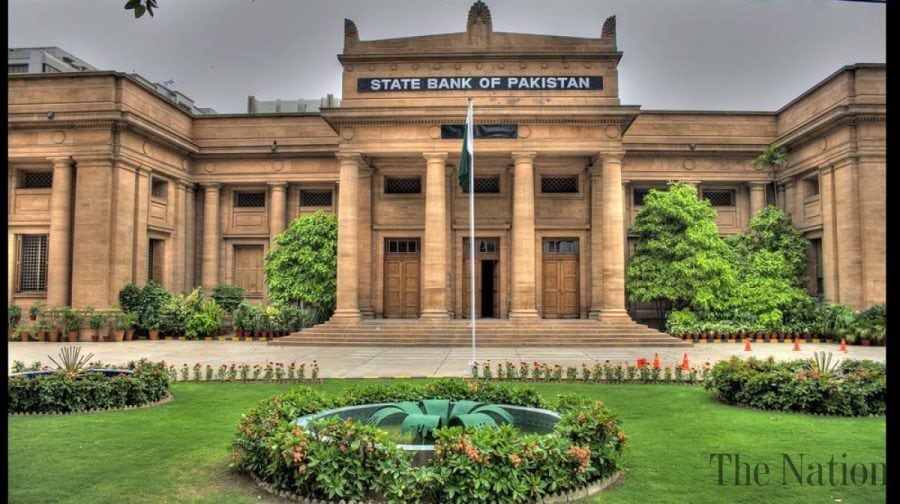

The State Bank of Pakistan (SBP) authorized banks and other service providers to charge a small fee for high-value transactions on Wednesday, but low-income people would continue to be able to utilize digital transactions for free.

Following the emergence of Covid-19 in the first quarter of 2020, the State Bank took a number of steps to deal with the unusual situation, including advising banks and other service providers to provide free Inter Bank Fund Transfer (IBFT) services to all of their customers, regardless of transaction size.

The SBP has now issued instructions to banks to offer free digital fund transfer services to individual clients up to a monthly aggregate sending limit of Rs25,000 per account or wallet. Banks, on the other hand, may opt to set this aggregate limit at a greater level. Individual clients would be able to make as many free money transfer transactions as they wanted while staying within their monthly free transfer limit.

Individual users may be charged a transaction fee of no more than 0.1 percent of the transaction value or Rs200, whichever is lesser, for transactions exceeding the monthly aggregate limit of Rs25,000 per account. This would allow service providers to recoup a portion of the expenses associated with providing interbank money transfer services while also allowing them to develop viable and creative business models.

“Surely banks will make money with this decision while it would be slightly discouraging for the stakeholders. But it is not possible to go back to the chequebook system,” said Samiullah Tariq, Head of research at Pakistan Kuwait Investment (PKI).

At the same time, the digital system adds the ability to make payments or withdraw cash without having to travel to the bank and worry about the bank’s hours, he said.

PRISM (Pakistan Real-time Interbank Settlement Mechanism) completed 972,000 transactions worth Rs92.2 trillion in the first quarter of FY21. These transactions increased by 36% in volume over the previous quarter, but decreased by 1% in value. In addition to interbank funds transfers (settlement transactions between participating institutions), PRISM has facilitated customers through its customers’ transfers facility, which accounts for 89 percent of the total volume of PRISM transactions, while the government securities transfers facility accounts for 65 percent of the total value of transactions as of the third quarter.

During the quarter under review, e-banking channels such as RTOBs, ATMs, POS, eCommerce, mobile banking, internet banking, and call centres handled 253.7 million transactions worth Rs19.1 trillion. ATMs account for the majority of e-banking transactions, accounting for 53% of total volume. In the second quarter of FY21, 296.7 million transactions worth Rs21.4 trillion were completed. With 51 percent, ATMs processed the bulk of the money.

PRISM handled approximately 1 million transactions worth Rs94.9 trillion in the period under review. The value of these transactions increased by 3% on a quarterly basis.

In terms of the Covid-19, the situation has improved and is now promising. In light of this, the SBP evaluated the existing IBFT pricing structure and made certain adjustments to guarantee that banks and other financial institutions continue to offer free IBFT services on a long-term basis, according to the circular.

The new guidelines, according to the central bank, urge banks to provide free digital money transfer services to their clients in order to boost the adoption of digital payments in the nation.

The SBP has also informed banks that all digital fund transfer services between different accounts within the same bank would remain free. Additionally, inbound interbank money transfer operations will be free. The SBP has also ordered banks to ensure that charged and free IBFT amounts, as well as relevant fees, are properly disclosed to consumers by sending frequent alerts through SMS, apps, and email.

Banks are obliged to send free SMS to their clients’ registered cellphone numbers after each digital transaction informing them of the transaction amount and costs being recovered.