ISLAMABAD – The National Savings Bank or ‘Qaumi Bachat Bank’ is one of largest financial institution in Pakistan that aims at promoting financial inclusion and saving culture.

The Qaumi Bachat Bank offers various products, including Defence Savings Certificates, Special Savings Certificates, Behbood Savings Certificates and Short Term Savings Certificates with lucrative profit rate.

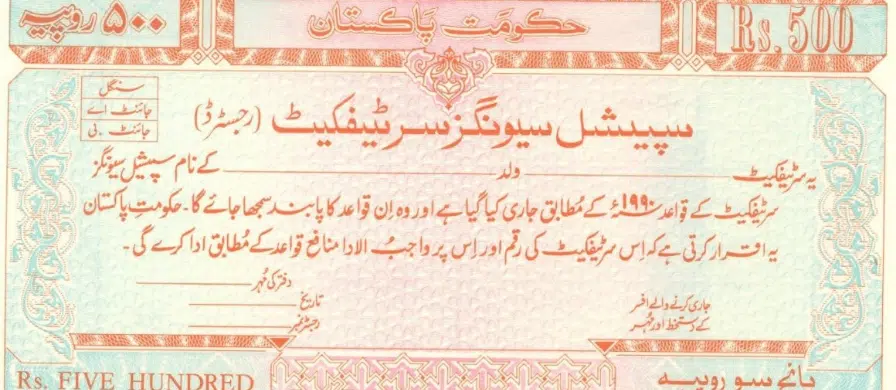

People make investment with the bank keeping in view their needs. Special Savings Certificates one of the popular products offered by the National Savings.

Special Savings Certificates (SSCs) scheme was launched keeping in view the needs and demands of small and medium range investors with a unique investment opportunity of bi-annual returns on their investments. This scheme was first launched on February 4, 1990.

The certificates are offered in different denominations – Rs. 500, Rs. 1,000, Rs. 5,000, Rs. 10,000, Rs.50,000, Rs. 100,000, Rs. 500,000 and Rs1,000,000.

With a tenure of three years, the investment offer is for the general public. Profit is paid to the investors on the completion of each period of six months.

Special Savings Certificates New Profit Rate from Jan 26

The National Savings has revised profit rates with effect from January 26, keeping in the view the various factors.

As per the revised policy, the profit rate for first five months will be 16 percent while it will be 16.6% for the sixth month.

Profit No 1 to 5 16% per annum Rs8,000 per Rs100,000 (Per 6 months)

Profit No 6 (Last) 16.6% per annum Rs8,300 per Rs100,000 (Per 6 months)