ISLAMABAD – The National Savings or Qaumai Bachat offers reasonable profit on Bahbood Savings Certificates to help widows, disable persons and the elderly people to meet their monthly expenses.

However, the profit rate is revised by the Central Directorate of National Savings time to time keeping in view the inflation rate and other factors in the country.

The Bahbood Certificates are considered one of the most attractive investment category for this group of people in Pakistan.

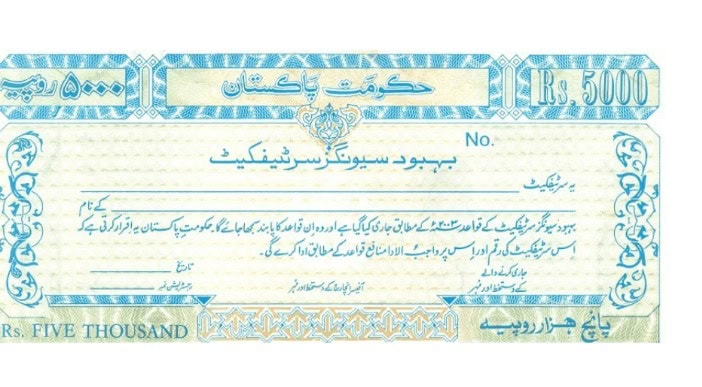

The Behbood Savings Certificates are available in the denominations of Rs5, 000, Rs10,000, Rs50,000, Rs 100,000, Rs500,000 and Rs1,000,000.

Profit is paid on monthly basis started from the date of purchase of the certificates.

Behbood Certificates Investment Limit

A single person can make a maximum investment of Rs7.5 million while the limit is Rs15 million for joint investors.

Behbood Savings Certificates Latest Profit 2025

The Qaumi Bachat bank revised the profit rates on Bahbood certificates in November 2024 and they are still in place in January 2025.

It has fixed the profit rates on Behbood Savings Certificates at 13.92 percent or Rs1,160 on each investment of Rs100,000.

It is recalled that withholding tax is not collected on the profit earned on Bahbood Certificates. The BSC are also exempted from Zakat collection.