Doha: The Qatar Investment Authority (QIA) plans to invest $3 billion in Pakistan, Qatar’s Emiri Diwan said on Wednesday, lending support to the South Asian nation’s cash-strapped economy.

With foreign reserves as low as $7.8 billion, barely enough for more than a month of imports, Pakistan is experiencing an economic crisis and a balance of payments catastrophe. The nation is also dealing with an expanding current account deficit, the rupee weakening versus the dollar, and inflation that reached more than 24% in July.

“The Qatar Investment Authority announced its aspiration to invest $3 billion in various commercial and investment sectors in the Islamic Republic of Pakistan,” the Emiri Diwan said, without giving details.

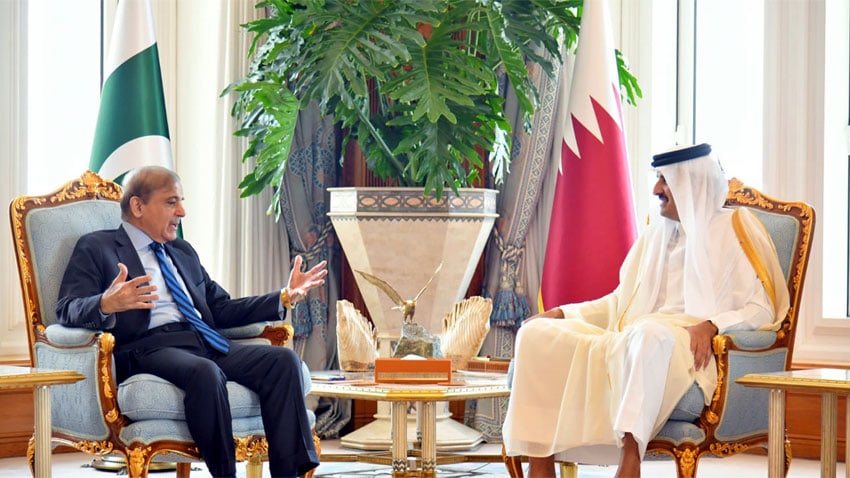

The announcement has come during the visit of Prime Minister Shehbaz Sharif’s two-day visit to Doha.

On Wednesday, PM Shehbaz met the Amir of the State of Qatar, His Highness Sheikh Tamim bin Hamad Al Thani Diwan-e-Amiri.

During the meeting, PM Shehbaz and the Amir discussed bilateral ties and explored ways to further strengthen the cooperation between Pakistan and Qatar. The two countries also agreed to promote bilateral cooperation in multiple areas.

“His Highness stressed the importance of the brotherly and strategic relations between the two countries and their aspiration to enhance economic partnership by raising trade exchange and promoting investments through the Qatar Investment Authority,” Emiri Diwan said.

The prime minister’s visit to Qatar precedes an International Monetary Fund meeting next week that is expected to approve more than $1 billion in financing that has been stalled since the beginning of the year.

Read: Pakistan to get IMF tranche in first week of September

On Tuesday, PM Shehbaz invited the QIA, Qatar’s $450 billion sovereign wealth fund, to invest in Pakistan’s energy and aviation sectors.

He had previously said he would highlight sectors including renewable energy, food security, industrial and infrastructure development, tourism and hospitality.

With additional input from Reuters.