Zubair Yaqoob

Karachi

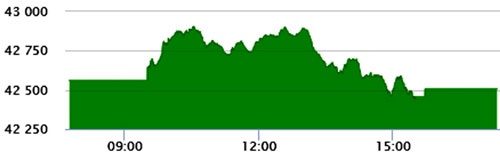

Market traded in the range of -122pts and +345pts, closing the session at -54pts. Cement Sector stocks performed well on the expectation of rate hike in North and meeting among Cement manufacturers, however, later during the session the expectation did not materialize which resulted in Cement stocks losing price gains made earlier.

OGDC, which rebounded from yesterday’s lower circuit, maintained the position but closed red. Decline in international crude prices caused investors to stay cautious on Oil & Gas chain and therefore OMCs and Refineries faced selling pressure. Cement sector led the volumes with 79.3M shares, followed by Technology (34.9M) and Banks (21.8M). Among scrips, MLCF realized volumes of 27.5M, followed by WTL (16.5M) and FCCL (13.6M).

The Index closed at 42,507pts as against 42,561pts showing a decline of 54pts (-0.1% DoD). Sectors contributing to the performance include Chemical (+14pts), Banks (+9pts), Tobacco (-32pts), Power (-14pts), Autos (-14pts), E&P (-11pts) and O&GMCs (-11pts). Volumes increased from 178mn shares to 230.8mn shares (+30% DoD). Average traded value increased by 5% to reach US$ 63.2mn as against US$ 60.1mn. Stocks that contributed significantly to the volumes include MLCF, WTL, FCCL, DGKC and BOP, which formed 36% of total volumes. Stocks that contributed positively include HBL (+24pts), COLG (+17pts), EFERT (+9pts), BAFL (+7pts) and SRVI (+7pts). Stocks that contributed negatively include PAKT (-32pts), LUCK (-14pts), HUBC (-13pts), OGDC (-12pts), and HMB (-11pts).