Zubair Yaqoob

Karachi

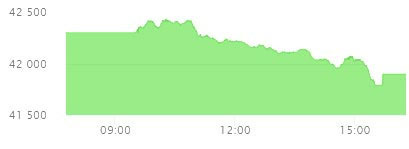

Following Tuesday’s slide, Market went down by another 508pts and closed the session at this level (unadjusted). SBP’s decision of not cutting the rates at this stage caused concern amongst investors and resulted in booking profits in Cement, Steel sectors. On the contrary, E&P and OMCs performed better in relative terms on the back of slight improvement in international crude oil prices. Start of market saw FFBL announcing financial results which were poorer than anticipation and caused the share price declining to lower circuit. Technology sector topped the volumes with 34.3M shares, followed by Cement (26.1M) and Banks (23.9M). WTL realized trading volume of 22.7M shares, whereas HASCOL realized (17.9M) and MLCF (10.8M). The Index closed at 41,899pts as against 42,299pts showing a decline of 400pts (-0.9% DoD). Sectors contributing to the performance include Banks (-148pts), Cement (-69pts), Fertilizer (-53pts), Power (-31pts), and Inv Banks (-21pts). Volumes increased by 4% to reach 197.1mn shares as against 189mn. Average traded value increased by 10% to reach US$ 47.9mn as against US$ 43.4.