ZUBAIR YAQOOB

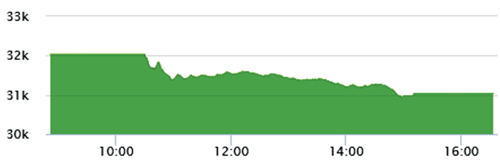

KARACHI Market headed south Monday on the back of negative development on OPEC+ deal, which although announced hefty production cuts, but still not enough to meet the global oil demand. Another key trigger awaited by Oil & gas scrips were the announcement of Official Selling Price (OSP) by Saudi Aramco, which was already delayed by a week for reasons of disagreement on production cuts among OPEC, NOPEC and G20 countries. The OSP announcement came by the end of session, during MoC, and saw selling activity on KSE100 increased further. During the session, the benchmark index saw a reduction of 1105pts, and closed -1059pts (unadjusted). Early on, the index bore significant selling pressure in HUBC, which hit lower circuit after realizing trade of approx. 2.7M shares and maintained lower circuit by close of session. Besides, oil & gas scrips, selling activity was observed almost across the board in Cement and Banking sector scrips as well. Cement sector continued the lead in terms of trading volumes with 39.7M shares, followed by O&GMCs (21.8M) and Power (14M). Among scrips, HASCOL topped the volumes with 16.9M shares, followed by MLCF (12.7M) and PAEL (8.2M).