Pakistan Stock Exchange (PSX) endured another volatile week as investors were concerned over the delay in revival of the International Monetary Fund (IMF) loan programme amid declining foreign exchange reserves and a deteriorating macroeconomic outlook.

However, despite those negative developments, the bourse ended the week in the green, driven by some drastic measures taken by the government. The market got some respite on Monday and registered slight gains as the rupee recovered against the US dollar in the inter-bank market.

Bears returned to the bourse, dominating trading for the next two days. On Tuesday, investors stood on sidelines owing to expectations of a further hike in policy rate in the upcoming monetary policy announcement. Downgrading of Pakistan’s local and foreign currency credit rating to Caa3 from Caa1 by Moody’s in the wake of a continuous fall in foreign currency reserves and rupee’s depreciation dented investor confidence on Wednesday. Consequently, the market remained in the red zone.

Investor sentiment flipped on Thursday in anticipation of reaching a staff-level agreement with the IMF as the government took steps to meet the lender’s conditions. Optimism prevailed on Friday as well after the State Bank of Pakistan (SBP) jacked up its key policy rate by 300 basis points (bps) to fulfill conditions for revival of the IMF loan programme.

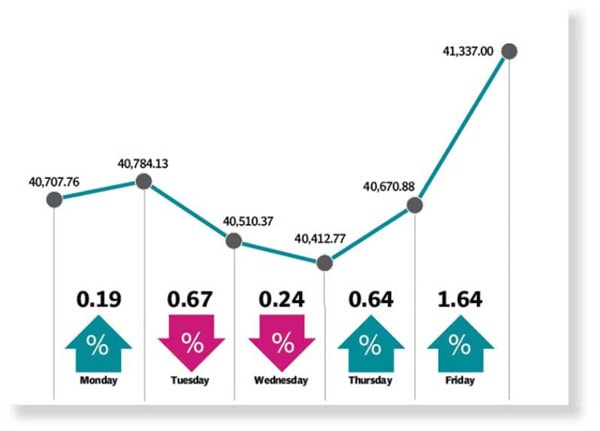

The benchmark KSE-100 index gained 629 points, or 1.55% week-on-week, and settled at 41,337. JS Global analyst Wasil Zaman, in his report, noted that the delay in IMF programme together with political uncertainty and earlier-than-scheduled monetary policy meeting dragged the KSE-100 index down through a major part of the week before the index bounced back while reacting to the 300bps rate hike by the State Bank.

Sector-wise, banks (+3.8% week-on-week) were among the top performers, following favourable news about the tax rate in relation to the advances-to-deposit ratio (ADR), he said. Foreigners were net buyers ($0.3 million) during the week, Zaman added.

On the news front, citing increasingly fragile liquidity, Moody’s slashed Pakistan’s credit rating to Caa3 whereas the outlook was switched from negative to stable. Inflation soared further, hitting 31.5% year-on-year in February 2023, which was the highest since 1965. Pakistani rupee also had a turbulent week, sliding further by 7% against the US dollar.

Trade deficit narrowed by 35% to $1.7 billion in February, driven by 18% contraction in imports. On the other hand, SBP’s foreign currency reserves picked up $556 million to $3.8 billion on the back of $700 million commercial loan disbursement by China, the JS analyst said. Arif Habib Limited, in its report, said that the week kicked off on a negative note due to uncertainty about the resumption of IMF programme.

“This uncertainty persisted throughout the week as the market was waiting for the monetary policy committee to meet,” it said. On Thursday, the SBP decided to increase the policy rate by 300bps to 20%. It was dictated by the Consumer Price Index (CPI), which rose to 31.55% YoY in February 2023, as food, beverages and transportation charges increased substantially.

The hike in policy rate signalled that Pakistan had met all the prerequisites for the staff-level agreement with the IMF and propelled the market higher towards the end of the week, AHL said. In terms of sectors, positive contribution came from banks (328 points), miscellaneous (169 points), exploration and production (103 points), power (68 points) and fertiliser (61 points).

Negative contribution came from technology and communication (71 points), cement (46 points) and tobacco (27 points).

In terms of individual stocks, positive contributors were Pakistan Services (167 points), United Bank (116 points), Hub Power (68 points), Meezan Bank (66 points) and MCB Bank (55 points). Negative contributors were Systems Limited (55 points), Lucky Cement (33 points), Pakistan Tobacco (27 points), Javedan Corporation (13 points) and Ghani Glass (12 points), the AHL report added.