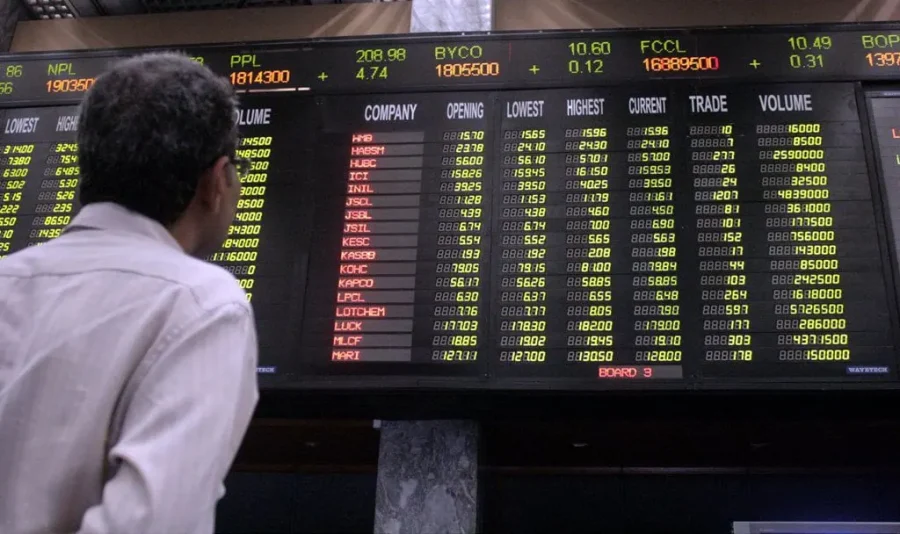

KSE-100 index advances by 661 points

Pakistan Stock Exchange (PSX) continued its positive momentum and posted smart gains in the outgoing four-day trading week, buoyed by share buyback announcements, strong financial results and cherry-picking of stocks that had dropped to attractive valuations. The week began on Tuesday with a positive session on the back of share buyback announcements by Lucky Cement and Habib Bank sponsors coupled with robust corporate results.

Investor optimism continued on Wednesday as trade deficit shrank 39.6% year-on-year, giving a boost to buying activity at the bourse. However, the KSE-100 index endured mixed sentiment in a highly volatile session on Thursday when investors opted to book profits at attractive valuations. Things took a turn for better on Friday as the index gained over 100 points due to cherry-picking, though investor participation remained low. The KSE-100 index gained 661 points, or 1.6% week-on-week, and settled at 42,242 by the end of the week.

April 2023, was mainly driven by food inflation.

Cement dispatches touched a nine month low as they dropped 22% MoM to 2.95 million tons in April on the back of tough macro conditions.

Despite the sequential improvement of 6%, oil marketing companies’ sales were down 47% YoY in April and 24% YoY during 10MFY23.