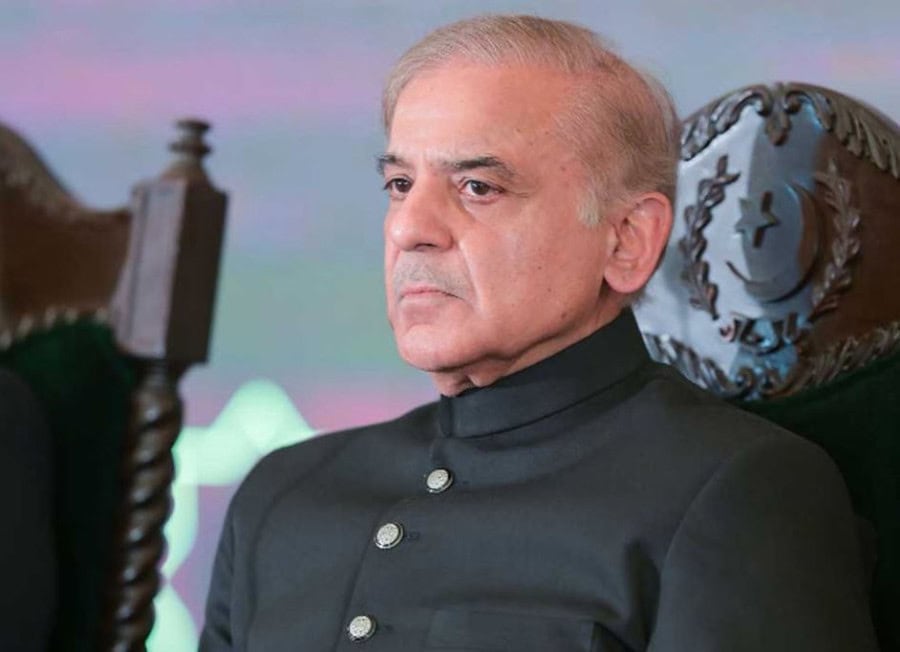

Peshawar: As talks with the International Monetary Fund (IMF) entered into the third day, Prime Minister Shehbaz Sharif Friday said that the global lender was giving a “very tough time” to Finance Minister Ishaq Dar and his team.

Addressing an Apex Committee meeting in Peshawar, PM Shehbaz Sharif admitted that Pakistan’s economic challenge at this moment was “unimaginable”.

“The conditions we have to fulfil [to complete the IMF review] are beyond imagination,” the premier said without elaborating.

The IMF technical team is currently in Islamabad, with Pakistan trying every option to persuade the Fund to revive the ninth review under the Extended Fund Facility (EFF).

Under the ninth review, Pakistan is to receive $1.18 billion from the IMF, which would help ease the pressure on Pakistan’s precious forex reserves, which have fallen to the lowest levels since 2014.

IMF or no IMF? | By Farrukh Saleem

The State Bank of Pakistan reported Thursday that Pakistan’s forex reserves plunged 16% to a dangerously low level of $3.08 billion during the week that ended on January 27, 2023.

The SBP-held forex reserves fell sharply by more than $592 million. Similarly, those held by commercial banks also dropped by more than $119 million to clock in at $5.655 billion.

Cumulatively, the net reserves plunged $771.5 million to settle at $8.74 billion during the period under review.