Zubair Yaqoob

Karachi

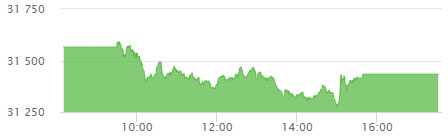

Market has been trading in a narrow range for the past week without breaching 31K level, although recent sessions have seen Index largely adjusting downwards. Selling pressure was evident in index heavy weights like ENGRO, LUCK, OGDC, PPL, HBL and UBL, which kept any increase firmly in check. Market on Close saw rates spiking for KEL, BOP, LUCK, OGDC.

Power sector performed well in volume terms by registering 34.5M shares on the bourse, out of which KEL garnered 31.4M shares. This was followed by Cement Sector (17.4M) and Technology (14.9M). Among scrips, WTL and MLCF trailed KEL with 11.8M and 10.4M shares respectively. The Index closed at 31,434pts as against 31,565pts showing a decline of 131pts (-0.4% DoD). Sectors contributing to the performance include Banks (-55pts), Fertilizer (-47pts), O&GMCs (-20pts), Power (-18pts) and Chemical (-12pts). Volumes increased further from 104.7mn shares to 124.2mn shares (+19% DoD).

Average traded value, on the contrary, declined by 15% to reach US$ 22.6mn as against US$ 26.7mn. Stocks that contributed significantly to the volumes include KEL, WTL, MLCF, ASTL and BOP, which formed 49% of total volumes. Stocks that contributed positively include MCB (+21pts), KEL (+13pts), DAWH (+12pts), EFUG (+6pts) and BOP (+6pts). Stocks that contributed negatively include HBL (-46pts), ENGRO (-40pts), HUBC (-36pts), BAFL (-16pts), and SEARL (-11pts).