Staff Reporter

Karachi

The stock market got a reprieve from the bearish trend of the past two days as the benchmark index managed to finish trading on a positive note.

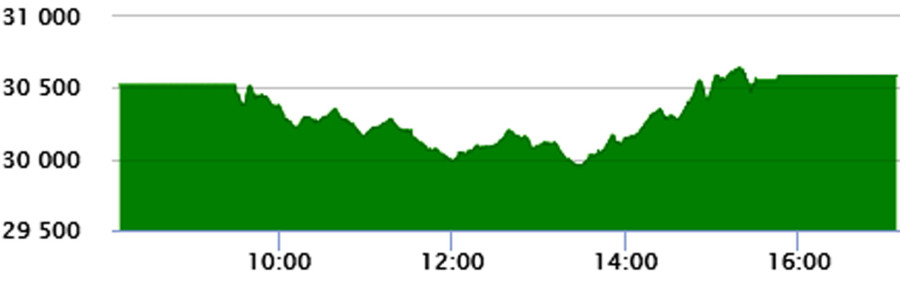

The KSE-100 index fell from the moment trading began, pushed lower by selling pressure on oil and gas exploration companies. News regarding divestment of government stake in Oil and Gas Development Company (OGDC), Pakistan Petroleum Limited (PPL) and Kot Addu Power Company had a significant selling impact.

Deteriorating macroeconomic indicators aggravated the situation as the fiscal deficit jumped to 8.9% of gross domestic product (GDP) in FY19, despite government’s numerous efforts to cut expenditures and boost revenues. Resultantly, the market lost over 550 points in intra-day trading, however, it managed to post decent recovery due to strong power sector earnings and announcement to privatise more public sector enterprises.

At close, the benchmark KSE 100-share Index recorded an increase of 64.25 points, or 0.21%, to settle at 30,584.85 points.

JS Global analyst Maaz Mulla said equities closed on a flat note as the bourse remained under pressure due to developments on the political front. “Moreover, the Privatisation Commission board has approved the expansion of the active privatisation list by adding 10 entities including PPL and OGDC, which was negative for the market,” he said.