Zubair Yaqoob

Karachi

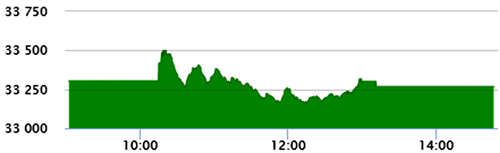

KSE-100 traded in a narrow range between +197pts and -145pts, closing the session -36pts. The session low volumes as well compared with recent past sessions. Selling pressure was evident in Banks, E&P and Cement sectors.

International oil prices had little impact on investor sentiment, which is affected more from upcoming MSCI rebalancing. Cement sector led the volumes with 15.7M shares, followed by Technology (11.3M) and O&GMCs (11.1M).

Among scrips, UNITY realized 9.3M shares, followed by HASCOL (5.8M) and MLCF (5.5M). The Index closed at 33,267pts as against 33,304pts showing a decline of 37pts (-0.1% DoD).

Sectors contributing to the performance include Banks (-50pts), Fertilizer (-29pts), Autos (-12pts), O&GMCs (+32pts), Power (+25pts), Food (+20pts). Volumes declined from 175.8mn shares to 88.0M shares (-50% DoD). Average traded value also declined by 51% to reach US$ 23.9mn as against US$ 46.8mn. Stocks that contributed significantly to the volumes include UNITY, HASCOL, MLCF, HUMNL and TRG, which formed 34% of total volumes.

Stocks that contributed positively to the index include HUBC (+27pts), NESTLE (+26pts), SNGP (+19pts), PAKT (+12pts) and PSO (+6pts). Stocks that contributed negatively include LUCK (-17pts), UBL (-13pts), ICI (-12pts), ENGRO (-11pts), and HBL (-10pts).