Zubair Yaqoob

Karachi

Following the SBP’s decision to defer Monetary Policy for next two months, gave banking scrips the much needed impetus to rally. Anticipation of further rate cut died with SBP’s decision and investors view this decision as a signal of interest rate bottoming out. Banking sector scrips, especially HBL rallied and traded near upper circuit after posting significant earnings last Friday. UBL is scheduled to post financial results in the first week of August, which gave another reason for the Banks to perform. Besides Banks, Cement sector rebounded after adjusting to selling pressure in the outgoing week.

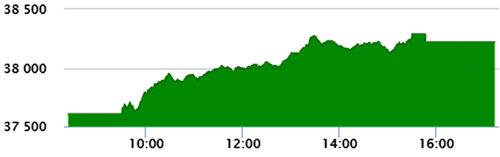

Resultantly, Index posted gains of 684pts and closed the session +614pts. Technology sector led the volumes with 39.4M shares, followed by Banks (39.1M) and Cable (30.2M). Among scrips, PAEL topped the volumes with 28.9M shares, followed by TRG (20M) and PRL (18.4M). The Index closed at 38,221pts as against 37,608pts showing increase of 614pts (+1.6% DoD).

Sectors contributing to the performance include Banks (+283pts), Cement (+75pts), Technology (+47pts), E&P (+45pts) Fertilizer (+45pts). Volumes increased from 266.5M shares to 288.1mn shares (+8% DoD). Average traded value increased by 24% to reach US$ 79.5mn as against US$ 64mn.