Doubling the allocations in Federal Budget

WHAT will happen if the allocation in every head of expenditure in the federal budget is doubled? Certainly there could be nothing better than this for the trembling economy.

A 30% of this surplus would be sufficient to compensate the existing employees in every sector.

The remaining 70% would be usable for further initiatives, new projects, improving infrastructure, expanding networks, expanding facilities, hiring new human resources, doing new research, expanding the health coverage and others.

But the question is how can we manage resources for this increase and how can we turn this dream into reality? In fact, it is very simple to manage the money to double allocation for every expenditure head in the federal budget.

That would need to adopt the strategy adopted by all advanced economies i.e. to bring the policy rate below 1%.

At present, Rs 2631 billion are consumed to repay the mark-up on domestic debt which makes 41% of the federal budget. The mark-up payments are so high only because of the wrong choice of policy rate.

The mark-up payments on domestic debt are associated with policy rate, which is the official interest rate decided by the State Bank of Pakistan. The policy rate in Pakistan is one of the highest rates in the world.

Today, the policy rate in Pakistan is 7%, which is 28 multiples of the policy rate in the United States and 70 multiples of the policy rate in the UK.

This means if US pays interest of 1 billion on some specific amount of loan, Pakistan would need to pay 28 billion for the same amount.

This also means if the domestic debt was priced at the rate prevailing in US, the allocation for mark-up payments could be reduced to less than 100 billion from 2631 billion, leading to savings of over 2500 billion.

These 2500 billion are sufficient to give a 50% extra to the defence expenditure and a 100% extra to every other head of expenditure.

What else do we need for a good budget? Not only the US and UK, many other developing and developed countries have policy rate much lower than Pakistan.

The policy rates in Thailand, Malaysia, Chile, Philippine and Brazil are 0.5%, 2%, 0.5%, 1%, 1.75%, 0.5%, and 2% respectively. The policy rate in Pakistan is higher than all the countries of South Asia.

The question arises, what is the logic of keeping policy rate so high and imposing a burden on the government? The Monetary Policy Statements issued by the SBP indicate that the main reason for keeping policy rate so high is the fear of inflation.

The conventional economic theories say that by reducing the interest rate, inflation may increase.

Therefore, in an attempt to avoid inflation, SBP keeps policy rate so high. However, the historical data strictly opposes the validity of these conventional theories.

After the Corona pandemic, most of the countries in the world reduced their policy rates drastically and this reduction didn’t spark any inflation.

For example, UK reduced the policy rate from 0.7% to 0.1%. If the conventional theories were valid, such a huge reduction in policy rate should spark inflation. But the inflation in the UK after this reduction has been less than before.

Brazil reduced policy rate from 14% to 2% during the years 2017-20. The inflation in Brazil today is much lower than in 2017.

While there is much evidence to show that excessive currency printing led to hyperinflation in some countries, there is no single example to show that there was any high inflation caused by reduction in policy rate.

This shows that the fear of inflation is unrealistic, and the cost of policy rate in terms of mark-up payment is so high.

So, following the global trend, SBP should reduce policy rate, so that trillions of rupees of the public exchequer could be saved and could be used for other productive purposes.

The reduction in policy rate would also pave the way for many of the commitments of the present government. For example, the government has committed to providing 10 million jobs.

If the policy rate is brought down to 1%, this means, the business loans could be made available at 4-5%.

With such a small mark-up rate, the availability of loan will turn into the best employment support scheme. Another question arises, by such a huge reduction in policy rate, the commercial banks wouldn’t agree to lend to the government.

In fact, commercial banks today have invested 25000 billion in the government securities and it is impossible for them to find alternate investment opportunities for this huge amount. The banks are bound to lend even if the policy rate is brought close to zero.

If there is some partial reduction in lending to the government, that can be mitigated by borrowing from SBP.

Suppose the banks withdraw a thousand billion from the government securities, they would need to search the clients in the private sector as an alternative. This monetary injection will help in promoting business.

If the government decides to provide partial guarantees on business loans, it will create a clear tilt toward business instead of consumption.

A thousand billion of cheap loans for business will bring revolution in the business sector. The low price loan with partial individual guarantee will reduce the chances of default.

When the banking sector is injected with some money, it has a multiplier effect; the banks can supply loans worth several multiples of the injected money. This will further help in promoting business.

The promotion of business through bank loans will increase the size of the formal sector and will increase the tax base. That will ensure a sustainable stream of revenue for the government in future.

All these dreams require one action, in line with the trend of the globe; i.e. to reduce the policy rates to less than 1% which will automatically create the fiscal space for all the budgetary allocations and will prepare a best employment scheme for the unemployed youth of the nation.

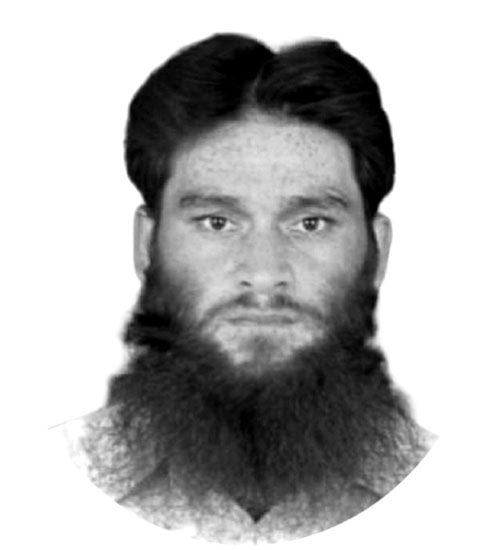

—The writer is Director, Kashmir Institute of Economics, Azad Jammu and Kashmir University.