Chinese Middle Corridor under the limelight

UPON the unveiling of the massive Belt and Road Initiative by the People’s Republic of China, three trade routes were initially identified. The first and southernmost route is the Ocean Road, which passes via the Red Sea and the Mediterranean while avoiding Southeast Asia and India. This longest trade route runs 20,000 kilometres from Beijing to Rotterdam, and the journey takes 45 to 60 days on average. Meanwhile, since it is a sea route, it may lower freight prices.

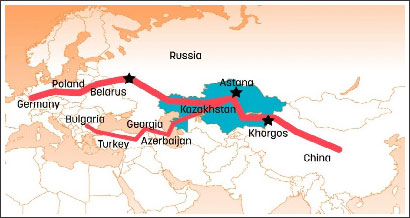

The second route, called the Northern Corridor, traverses Mongolian and Russian territory. It takes about 15 to 20 days to go around 10,000 kilometres. The third path is renowned as the Middle Corridor, which has recently come under the limelight due to the EU members’ ebbed desire to have trade exchanges and business with Russia. The Ukrainian crisis has shifted several international paradigms and impacted land transportation routes’ relative benefits. The northern route has the advantage of passing primarily through Russian territory, which spares freight the hassle of going through standard border crossing procedures. However, since Russia invaded Ukraine, shipments from China to the EU through this route have dropped by 40%.

In this scenario, while the Middle Corridor looks promising, it has its drawbacks. The foremost drawback is that it must pass through multiple Central Asian borders. While it traverses Kazakhstan by one branch, it cuts across Uzbekistan and Turkmenistan by the other. Taking a ferry across the Caspian Sea splits into two routes: one travels overland through Turkiye to the Balkan nations, and the other passes the Black Sea from Batumi, Georgia, to Romanian and Bulgarian harbours. The shortest trip, covering around 7,000 kilometres, takes 10 to 15 days to get to Europe.

The second hitch the Middle Corridor faces is the multimodal nature of this corridor, as it could lead to coordination issues if shipments are not appropriately handled. Additionally, congestion in Armenia’s Zengezur corridor put forth the third drawback. The Armenian-controlled corridor is around 60 kilometres, separating the Azerbaijani exclave of Nakhchivan from the rest of the country. Vladimir Putin, the president of Russia, mediated a cease-fire between Armenia and Azerbaijan following the Nagorno-Karabakh war in 2020. The cease-fire agreement’s Article 9 states: “All economic and transport connections in the region shall be unblocked. The Republic of Armenia shall guarantee the security of transport connections between the western regions of the Republic of Azerbaijan and the Nakhchivan Autonomous Republic to arrange unobstructed movement of persons, vehicles, and cargo in both directions.”

Armenia may revitalize this corridor, generate hundreds, if not tens of thousands, of jobs for its population, and gain the advantages of increasing trade if it can get out from its Turkiye entanglements. The corridor parallels the Aras River’s northern bank. Iran is interested in building a road connecting Nakhchivan and Azerbaijan on the southern bank of the same river. However, it is focusing on this project because it wants to control the path Turkiye will take to travel to Azerbaijan and Central Asian Turkic countries beyond the Caspian Sea, not because it wants to connect Azerbaijan proper to Nakhchivan.

In a similar dispute involving the Lachin corridor in Armenia, Azerbaijan does not impose any limitations on Armenians desiring to go to the autonomous Nagorno-Karabakh area of Azerbaijan and vice versa, in contrast to Yerevan’s unfavourable attitude.

The Kars-Tbilisi-Baku railroad connects Turkiye and Azerbaijan, an alternative route for Turkiye. Thus, the Armenian blockade doesn’t stop Turkiye from reaching the Central Asian Turkic countries but makes it more challenging and expensive for her.

Investors from Europe and Asia have expressed interest in enhancing the Middle Corridor’s cargo transportation infrastructure. To establish Turkiye’s Izmit Bay as a key crossing point between Asia and Europe, the Austrian Federal Railways and Pacific Eurasia have worked together. This year, the cargo being moved along this route has surged by more than 120 percent.

Many efforts were made to improve the effectiveness of freight transportation in Turkish harbours even before the Ukrainian conflict. The Middle Corridor is already being used by the Finnish company Nieminen Logistics, the Dutch company Rail Bridge Cargo, the Danish shipping business Maersk, the German company CEVA Logistics, and Chinese logistics operators and freight forwarders. By the end of 2022, an expected 3.2 million metric tons of freight will be moved via this route, which will be a six fold increase.

The call for greater connectivity will undoubtedly compel businesses and government agencies in the Middle Corridor countries to exert even more effort to get through administrative and technological challenges. These initiatives are more apparent now because the Ukrainian crisis has passed. They are currently attempting to construct new ports, ferries, and trains to improve soft infrastructure by streamlining border crossing procedures. Once implemented, these advancements will likely stay in use, making them an indirect result of the Ukrainian crisis.

The main concern is whether regional players’ expectations for cargo flows from China will be realized or if, given the current political and economic climate, they will merely end up as the owners of a “white elephant.” Time will tell. The Middle Corridor is still an exciting idea for the time being, but its future is still up in the air.