Oil prices plunged about 5% to an eight-month low on Friday as the US dollar hit its strongest level in more than two decades and on fears rising interest rates will tip major economies into recession, cutting demand for oil.

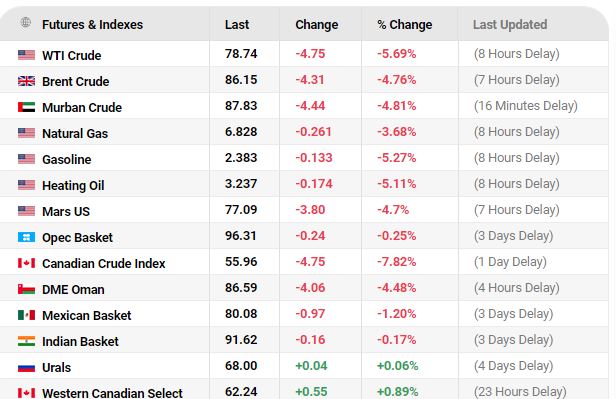

Brent futures fell $4.31, or 4.8%, to settle at $86.15 a barrel, down about 6% for the week. The US West Texas Intermediate (WTI) crude fell $4.75, or 5.7%, to settle at $78.74, down about 7% for the week.

It was the fourth straight week of declines for both benchmarks, the first time this has happened since December. Both were in technically oversold territory, with WTI on track for its lowest settlement since January 10 and Brent for its lowest since January 14.

The US gasoline and diesel futures were also down more than 5%.

The US Federal Reserve raised interest rates by a hefty 75 basis points on Wednesday. Central banks around the world followed suit with their own hikes, raising the risk of economic slowdowns.

“Oil tanks as global growth concerns hit panic mode given a chorus of central bank commitments to fight inflation. It seems central banks are poised to remain aggressive with rate hikes and that will weaken both economic activity and the short-term crude demand outlook,” said Edward Moya, senior market analyst at data and analytics firm OANDA.

The US dollar was on track for its highest close against a basket of other currencies since May 2002. A strong dollar reduces demand for oil by making the fuel more expensive for buyers using other currencies. – Agencies