Strengthening Shariah compliance of Islamic banking industry in line with the best international practices is one of the key pillars of SBP’s 3rd Strategic Plan for Islamic Banking Industry 2021-25.

Under the plan, SBP has been adopting Shariah standards of Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) in a systematic and gradual manner.

The standardization and harmonization in Shariah practices and procedures are helping in elevating the local Islamic banking industry at par with the international best practices.

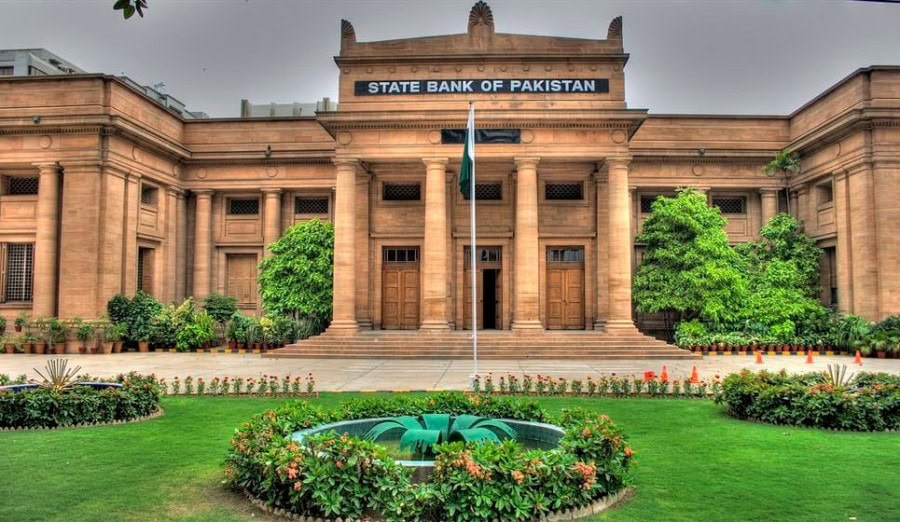

After a comprehensive process of evaluation and deliberations with the internal and external stakeholders, keeping in view our local environment, today the State Bank of Pakistan (SBP) has adopted four more AAOIFI Shariah standards on i) Salam and Parallel Salam, ii) Istisna’a and Parallel Istisna’a, iii) Combination of Contracts and iv) Irrigation Partnership (Musaqat), with certain clarifications and amendments.

Salam is a mode of finance frequently used in agriculture while Istisna’a is a mode generally used by Islamic banking institutions to provide financing where manufacturing / assembling / processing is involved. Irrigation partnership (Musaqat) standard can be used in agriculture sector, especially for orchard financing while standard on combination of contract provides guidance to Islamic banking institutions when making use of multiple contracts in their various arrangements to meet the needs of the customers. It may be noted that earlier SBP has already issued detailed general guidelines on Islamic financing for agriculture sector.

With adoption of these four standards, the total number of AAOIFI Shariah standards adopted by SBP has reached twenty while work on remaining standards is underway. Besides, there are few AAOIFI standards which have already been adopted by SBP as part of its various regulations, instructions and guidelines issued from time to time.

AAOIFI is a leading international organization primarily responsible for development and issuance of standards for the global Islamic finance industry. SBP has remained a key member of AAOIFI’s Board of Trustees.