Zubair Yaqoob

Karachi

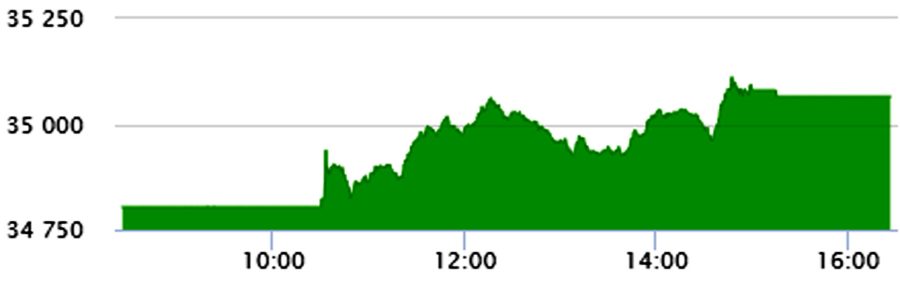

Banking sector performed well on Wednesday with BAFL hitting upper circuit and HBL, UBL & MCB also contributing positively to the Index. Though crude oil prices remained under pressure, renewed interest in E&P sector from investors in general and foreigners in particular helped these stocks maintain a plateau. Particular buying interest was also observed in Chemical stocks, which have been in the limelight whether due to COVID-19 or anticipated tax relief in the upcoming budget. EPCL, DOL, SPL performed well, whereas LOTCHEM after posting significant gains yesterday registered a nominal decline. Banking sector stocks topped the index with 32.8M shares, followed by Technology (24.5M) and Chemical (23.1M). Among scrips, PRLR registered treading volume of 11.7M shares, followed by TRG (10.8M) and BOP (9M). The Index closed at 35,065pts as against 34,804pts showing an increase of 262pts (+0.8% DoD). Sectors contributing to the performance include Banks (+273pts), Pharma (+24pts), Textile (+17pts), Technology (+15pts), E&P (-36pts), Cement (-10pts). Volumes declined from 238.3mn shares to 218.7mn shares (-9% DoD). Average traded value also declined by 13% to reach US$ 48.4mn as against US$ 55.6mn. Stocks that contributed significantly to the volumes include PRLR1, TRG, BOP, UNITY and LOTCHEM, which formed 22% of total volumes.