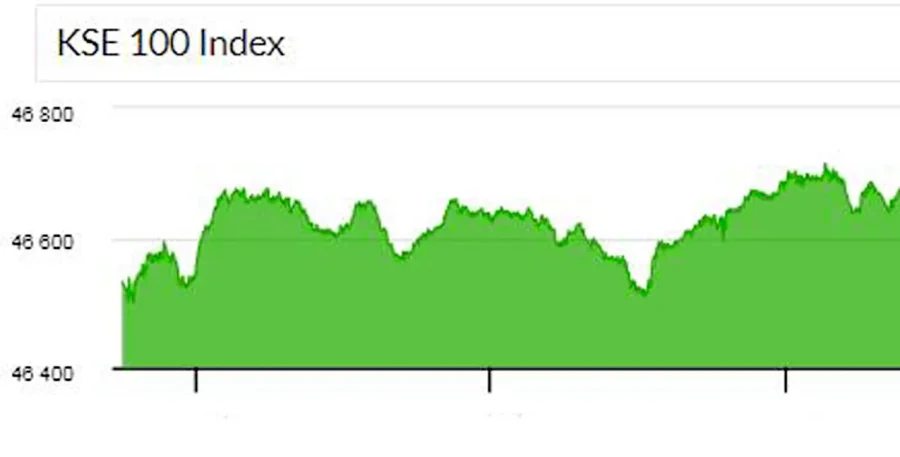

The 100-index of the Pakistan Stock Exchange continued with bullish trend on Wednesday, gaining 265.19 points, a positive change of 0.57 percent, closing at 46,682.53 points against 46,417.34 points the previous trading day.

A total of 429,515,564 shares were traded during the day as compared to 319,893,485 shares the previous day, whereas the price of shares stood at Rs 14.137 billion against Rs 10.259 billion on the last trading day.

As many as 352 companies transacted their shares in the stock market; 212 of them recorded gains and 121 sustained losses, whereas the share price of 19 companies remained unchanged.

The three top-trading companies were K-Electric Ltd with 58,856,601 shares at Rs 2.30 per share; WorldCall Telecom with 22,244,922 shares at Rs.1.41 per share and Pak Refinery with 18,394,805 shares at Rs 16.93 per share.

Reliance Cotton witnessed a maximum increase of Rs 31.88 per share price, closing at Rs 456.88, whereas the runner-up was Attock Refinery with an Rs 12.27 rise in its per share price to Rs 225.45.

Mehmood Tex witnessed a maximum decrease of Rs 28.69 per share closing at Rs 699.00, followed by Pak Services with Rs 20.01 decline to close at Rs 749.99.

Meanwhile Pakistani Rupee on Wednesday gained Rs 1.49 against the US Dollar in the interbank trading as it closed at Rs 287.03 against the previous day’s closing of Rs 288.52.

However, according to the Forex Association of Pakistan (FAP), the buying and selling rates of dollars in the open market stood at Rs 291.5 and Rs 294 respectively.

The price of the Euro decreased by Rs 1.22 to close at Rs 317.76 against the last day’s closing of Rs 318.98, according to the State Bank of Pakistan (SBP).

The Japanese Yen remained unchanged to close at Rs 2.04, whereas a decrease of 32 paisa was witnessed in the exchange rate of the British Pound, which traded at Rs 370.38 as compared to its last day’s closing of Rs 370.70.

The exchange rates of the Emirates Dirham and the Saudi Riyal decreased by 41 paisa and 39 paisa to close at Rs 78.14 and Rs 76.52 respectively.