Oil prices in the international market fell slightly on Thursday after gaining more than $3 in the prior session, with a strong dollar capping oil demand from buyers using other currencies and concerns over the faltering economic outlook clouding market sentiment.

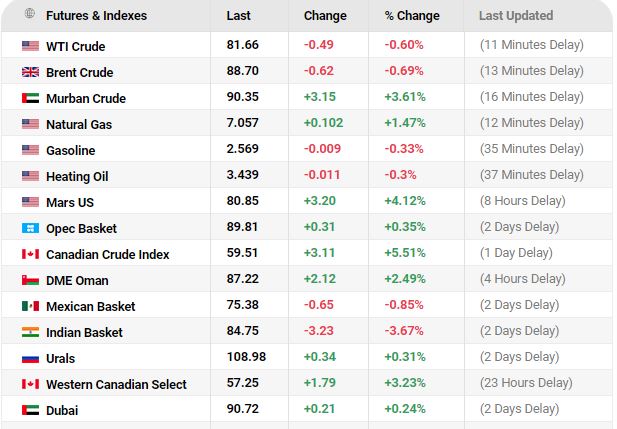

At around 05:30 GMT, the Brent crude futures fell by 52 cents, or 0.58%, to $88.80 per barrel, while the WTI crude futures dropped by 49 cents, or 0.60%, to reach $81.66 per barrel.

Both benchmarks had rebounded in the prior two sessions after reaching nine-month lows this week after a temporary dive in the dollar index and a larger-than-expected drawdown of the fuel inventory raised hopes of a consumer demand recovery.

However, the dollar index trended upward again on Thursday, dampening investor risk appetite and stoking fears of a global recession.

In China, the world’s biggest crude oil importer, travel during the week-long national holiday is set to hit the lowest level in years as Beijing’s persistent zero-COVID rules prompt people to stay at home and economic woes dampen spending.

On the other side of the world, the European Union proposed a new round of sanctions against Russia over its invasion of Ukraine, including tighter trade restrictions, more individual blacklistings and an oil price cap for third countries. – Agencies