Zubair Yaqoob

Karachi

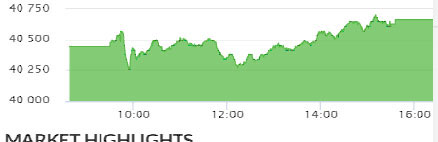

Market traded in a narrow range oscillating between -184pts and +222pts. Activity remained relatively slow as compared with yesterday, but buyers were cautious of market correction, which was anticipated since last week. Autos, Steel, Cement and Banking sector stocks saw selling pressure. Vanaspati sector led the volumes with 30.5M shares, followed by Chemical (30.2M) and Cement (29.3M). Scrip wise activity shows UNITY topping the chart with 30.5M shares, followed by FFL (19.3M) and KEL (15.8M). The Index closed at 40,665pts as against 40,443pst showing an increase of 222pts (+0.5% DoD). Sectors contributing to the performance include Cement (+51pts), Pharma (+27pts), Banks (+25pts), O&GMCs (+25pts) and E&P (+20pts). Volumes declined from 320.1mn shares to 254.6mn shares (-21% DoD). Average traded value also declined by 19% to reach US$ 59.5mn as against US$ 73.5mn. Stocks that contributed significantly to the volumes include UNITY, FFL, KEL, LOTCHEM and AGL, which formed 34% of total volumes. Stocks that contributed positively include LUCK (+29pts), POL (+27pts), UBL (+21pts), NESTLE (+19pts) and PSO (+13pts). Stocks that contributed negatively include OGDC (-10pts), HUBC (-10pts), PSMC (-7pts), NATF (-6pts), and BAFL (-5pts).