Zubair Yaqoob

Karachi

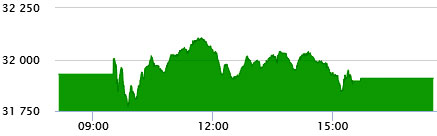

Market traded in a narrow range today with an oscillation of 337pts between +178pts and -159pts. Higher international crude prices managed to secure interest of investors in E&P & Refinery sectors, though OMCs saw profit booking. Besides, Banking sector scrips helped the Index to stay relatively positive and somewhat shielded the index from Cement sector onslaught that saw LUCK’s rates declining significantly in MoC. LUCK closed near day’s low, near lower circuits. With the exception of DGKC, which managed to post decent gains as compared to LDCP, other Cement sector scrips saw selling pressure. Cement Sector again managed to post high volumes with 25.5M shares, followed by Cable (16.9M) and Power (11.6M). Among scrips, PAEL ranked top with 16.7M shares, followed by MLCF (10.3M) and DGKC (7.3M). The Index closed at 31,909pts as against 31,929pts showing a decline of 20pts (-0.1% DoD). Sectors contributing to the performance include E&P (+35pts), Miscellaneous (+21pts), Banks (+17pts), Fertilizer (-36pts), Cement (-30pts), Power (-21pts). Volumes increased from 104.6mn shares to 121.8mn shares (+16% DoD). Average traded value also increased by 4% to reach US$ 33.2mn as against US$ 31.9mn. Stocks that contributed significantly to the volumes include PAEL, MLCF, DGKC, KEL and TRG, which formed 38% of total volumes. Stocks that contributed positively include HBL (+35pts), UBL (+30pts), PSEL (+21pts), PPL (+20pts) and EFERT (+11pts). Stocks that contributed negatively include LUCK (-35pts), BAHL (-26pts), FFC (-20pts), ENGRO (-20pts), and HUBC (-17pts)