Staff Reporter Islamabad

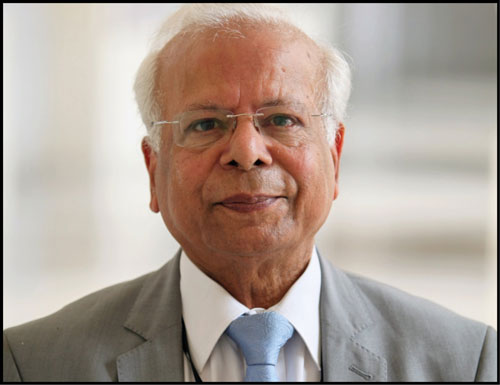

Former Governor State Bank Ishrat Hussain has asked Islamic Banking and Finance industry to do more to make it distinguished from conventional banking and play its role to bring down poverty and inequality in the country.

He was addressing as the Chief Guest at the 5th International Conference on Islamic Banking and Finance (ICIBF -2021) organized by the Institute of Business Management (IoBM).

In his virtual keynote speech Dr. Ishrat Hussain said that 18 percent market share and 30 to 32 percent growth rate is a good achievement but is short of our expectations at the beginning of Islamic banking in 2001.

We were expecting 25 percent market share of Islamic banking till 2021 but twenty years later we couldn’t achieve this target. Dr. Ishrat Hussain said that I would like to emphasis that Islamic banking is not only for Riba free which is one of its essential attribute but it is different from the traditional banking because it has a purpose that we have to take care of our brothers and sisters who are disadvantaged, poor and vulnerable and unless we bring them along with others to the same level of standard of living we are not performing our function as Islamic bankers.

He urged the Islamic banking industry to blend the essential instruments of Islamic system of finance including Zakat, Takaful, Qarz e Hasna to make sharia compliance products and services which can actually target the marginalized groups which need the finances.

Dr. Ishrat Hussain highlighted the importance of microfinancing for creating social impact and urged Islamic banks to lend in microfinance products specially for the backward areas of the country including Balochistan, South Punjab, KPK, rural Sindh instead of three big cities of the country.

He termed FinTech’s and collaboration among the Islamic banks key to expand the client base and promote financial inclusion in the country.

During his address, Mr. Talib S. Karim, President IoBM, said that result oriented-research must be developed based on the findings of this conference as students should learn from the deliberations.

Omar Mustafa Ansari, Secretary-General, AAOIFI, Bahrain said that Islamic mutual funds are generating a higher share.

He added that socio-economic growth has a great potential in Pakistan. Promoting social finance needs to be brought into mainstream finance, he added.

Junaid Ahmed, President and CEO, Dubai Islamic Bank, shared four life lessons with students including: humility, service to humanity, submission to Allah, and giving.

He touched upon relief measures initiated by the Government of Pakistan and the State Bank of Pakistan.

He shared DIB’s initiatives including a focus on digital banking, nurturing talent, women empowerment among others.

Syed Amir Ali, President & CEO Bankislami Pakistan said that such conferences are a great opportunity to connect academia with industry. Such deliberations also generate ideas to save humanity from Riba.

Muhammad Zahid Ahmed, Deputy CEO, Al Baraka Bank Pakistan suggested students learn the origins and history of Islamic Banking in Pakistan as it will guide them to better understand the way forward.

ICIBF-2021, a two-day conference will observe the challenges and opportunities in socio-economic impact, regulations, and human resource perspectives of the Islamic Banking and Finance Industry.