Developments in public debt

IN 2018, when the present government came into power, the total domestic public debt was about Rs 16,900 billion, of which Rs 9,700 billion was short-term debt.

The tenure of a short-term debt ranges from 3 months 12 months and the short term debt of that time was almost entirely in form of 3 month bills.

The government is bound to repay the debt on completion of tenure of a debt instrument, and she borrows new loans through another instrument to repay the existing.

If the new borrowing is through short term instrument, the markup is closely associated to the new policy rate. Therefore, a rise in policy rate implies higher markup on new debt and vice versa.

With the advent of the PTI government, the policy rate began to rise, so that the same debt that the previous government had borrowed at an interest rate of 5.75% was transferred into a debt having 13% interest rate.

At the same time, the PTI government focused on re-profiling the domestic debt into longer-term debt.

The government inherited 26% of the debt in form of long term debt instruments and today this ratio has gone up to 79%.

The tenure of a long-term debt instrument ranges from 3 years to 30 years. The longer term debt is usually charged with higher markup than the policy rate.

Today, when the policy rate has been reduced to 7%, the interest rate offered at 20 years Pakistan Investment Bonds is 11%. The terms of a long-term debt can be changed only at maturity.

Therefore, once a long term debt is borrowed, the incumbent government and the future governments will have to pay the pre-decided markup till the end of the tenure of the debt instrument.

A future change in policy rate will not affect the markup on long term borrowing till maturity.

Therefore, by borrowing the long term debt, the incumbent has decided the cost of borrowing for the future governments. Most of this debt was borrowed during 2019 and 2020 when the policy rate was at highest level.

The government is gradually transforming the remaining short term debt into longer term..

In other words, when the N-League government left power, they left short-term debt, the terms of which could be changed by the new government within three months.

The incumbent government changed the terms of borrowing and made all the loans more expensive for itself, and at the same time the government changed the debt profile into longer term.

Now, if the PTI stays in power or any other government takes charge, till the maturity of a debt instrument, the government will have to make payments at the interest rate decide today.

When PTI government took charge, a large portion of public debt was borrowed from the State Bank of Pakistan. In March 2019, the debt borrowed from SBP was about 7200 billion.

In the name of fiscal consolidation, the entire SBP debt was retired and was replaced with borrowing from commercial banks.

If debt is borrowed from SBP, the interest on this loan is paid to the SBP and the government as the custodian of public sector institutions, receives all this money.

In other words, there is no practical burden of this loan on the government except the entry in the balance sheet because the interest paid on it goes back to the government treasury.

The first thing the government did after Raza Baqir taking SBP’s governorship was to repay the SBP loan.

To make these payments, the incumbent borrowed from commercial banks, and now the interest money would land in the coffers of commercial banks.

By retiring the SBP loan, about 1 trillion per year would be diverted from government treasury to the commercial banks.

While the interest rate on short term debt changes shortly after change in policy rate, the interest rate on long term debt would not change till maturity.

If the policy rate goes down in future, this reduction will not have any effect on 79% of the public debt which is in the form of long-term securities.

A reduction in the policy rate will have an effect only on short-term debt which amounts to about 20% of the domestic public debt.

A third component of domestic public debt is in the form of prize bonds. The government does not need to pay interest on the prize bonds and distributes a limited amount of prizes on this debt and.

The PTI government discouraged the prize bonds and banned prize bonds of denomination 40,000 as soon as they came into power.

The government repaid the money lent through prize bonds of domination 40,000 and managed it by borrowing through expensive Pakistan Investment Bonds.

The debt borrowed through prize bonds amounted 985 billion in January 2019, which has decreased now to 600 billion as of January 21.

Thus an interest free debt of about 385 billion was transformed into high interest Pakistan Investment Bonds.

In total, during the 30 months of the current government, the domestic debt has increased by about 7800 billion, which is equivalent to 45% of the debt inherited by the incumbent.

In the style of 2018’s Imran Khan, the borrowing by incumbent during 30 months is equal to about 45% of the borrowing during the previous history.

The incumbent portrayed the public debt to be the biggest problem inherited from the previous government and remedied it by borrowing further at a record speed and a very bad legacy which the future government will not be able to change.

Note: This whole discussion is about domestic public debt, there is no role of exchange rate in it.

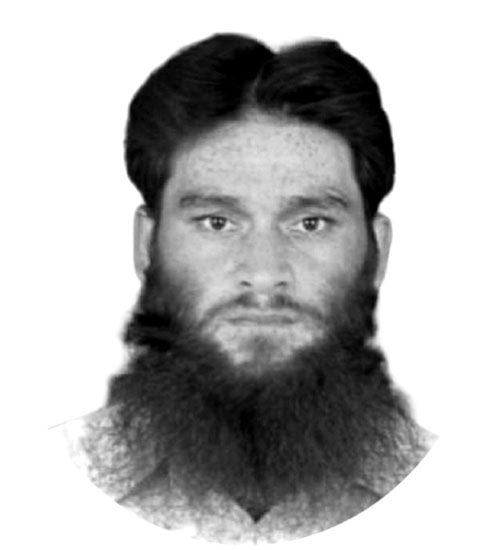

—The writer is Director, Kashmir Institute of Economics, Azad Jammu and Kashmir University.