Chinese BRI and Kyrgyzstan: The Way Forward

Chinese One Belt & One Road (BRI) has been improving business, economic, investment, joint venture and connectivity potential of Kyrgyzstan since 2013.

Kyrgyzstan is strategically located between Europe and Asia and its business environment, its global presence and its trade and investment conditions/potential have enabled it to become a base for larger production, procession and commodity distribution and transshipment in the Central Asian Region in which BRI would play an important role in the days to come.

Kyrgyzstan and China have already built strong trade and economic ties. China, under the flagship of the BRI, carries numerous projects in Kyrgyzstan in road and energy infrastructure rehabilitation, urban development, mining, manufacturing and other sectors of the economy due to which the economic collaboration and bilateral trade between the two countries would be further strengthened in the days to come.

Kyrgyzstan has been among the earliest supporters and participants of BRI and the two countries are expected to deepen their mutual cooperation in areas like agriculture, infrastructure development and connectivity as well as trade and investment facilitation.

China’s interest in Kyrgyzstan was further strengthened with the operationalization of the BRI in 2013.

Kyrgyzstan, which is flanked by China to the east and Uzbekistan to the west, is strategically important to the BRI.

Its location separates China from the rest of Central Asia and further afield to West Asia and the easternmost borders of Europe and thus is key to opening and securing trade routes to the region.

Thus completion of numerous projects of infrastructural development under the aegis of BRI in Kyrgyzstan would further diversify trade routes and greater regional connectivity options of China. Moreover, it would provide a win-win proposition for both the countries.

Obviously, Kyrgyzstan’s macro-economy is relatively open, and supportive. It has a competitive corporate tax rate of 10 percent (among the lowest in the region), low labor costs (lowest in the region) and relatively cheap electricity (cheapest in the region) as a result of its abundant hydroelectric resources.

Major flows of FDI to Kyrgyzstan started in the 2000s, benefitting mainly the country’s gold industry and FDI has since concentrated on mining industries.

In terms of the business environment, Kyrgyzstan ranks 80th in the World Bank’s 2020 Ease of Doing Business Report.

Constant structural and legislative reforms of the government have institutionalized the global best practices on tax administration; permits, technical regulations and inspection which have created a relatively strong regulatory environment.

Thus its economic stability and sustainability would be counter-productive for the rapid growth of BRI in the country.

According to the 2020 World Investment Report released by the United National Trade Conference (UNCTAD), in 2019, Kyrgyzstan received US$209 million in FDI flows and by the end of 2019 the country attracted a total of US$5.59 billion of FDI inflows.

Obviously, China is the largest source of investment to Kyrgyzstan, accounting for almost half of the FDI inflows. It is also Kyrgyzstan’s largest creditor, holding more than 40 percent of Kyrgyzstan’s large external public debt.

China has been Kyrgyzstan’s largest trading partner for imports as well as the fastest growing import market over the past 10 years.

For exports, China is Kyrgyzstan’s sixth largest trading partner in 2019. In 2019, the trade volume between China and Kyrgyzstan reached US$6.37 billion, up by 13.15 percent year-on-year, according to the data from the General Administration of China Customs.

China exported US$6.31 billion worth of goods to Kyrgyzstan in 2019. The main categories of China’s exports include apparel and clothing accessories, shoes, boots, leg warmers, and their parts, cotton, chemical fiber filament, machinery tools and parts, etc.

In return, Kyrgyzstan exported US$65.96 million to China, mainly goods like ore, slag and ash, copper, rawhide and leather, mineral fuels, mineral oil, wool and other animal hair, fruit, etc.

Interestingly, Chinese sponsored 261 projects have been financed in the Central Asian region within the BRI or bilaterally.

Specifically, according to CADGAT report, Kyrgyzstan has been implementing 46 projects, Tajikistan 44 projects, Uzbekistan 43 projects, whereas Kazakhstan has the largest penetration of Chinese investment with 102 projects in comparison with 26 in Turkmenistan that has the lowest number of projects in the region.

Overall, 237 bilateral and 24 multilateral projects are being carried out in Central Asia with Chinese investment, out of which 209 are local and 52 are regional

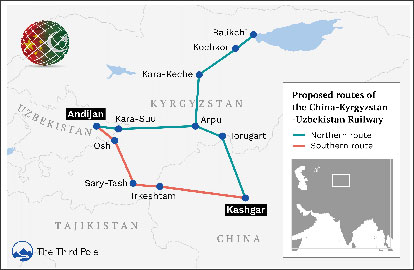

The development of a railway line heading West over the Kyrgyz Tan Shan, to Osh and along the Ferghana Valley through to Uzbekistan and to link up with connections there through to Iran and the International North-South Transportation Corridor (INSTC) is dream project of China under the flagship of BRI.

Such a line would provide the first trans-Central Asian railway from East to West and would also link up with Central Asian lines heading North-South, the proposed Trans-Afghan route from Uzbekistan south to Pakistan and the Arabian Sea Ports at Gwadar and Karachi, as well as spurs leading into Tajikistan.

Hopefully, successful completion of this mega project would bisect Central Asia to the four corners of the world for the first time and has seaport access important for counties like Kyrgyzstan that are completely landlocked.

The China-Kyrgyzstan-Uzbekistan (CKU) railway is open for business and the first cargo, US$2.5 million worth of electrical goods left Lanzhou in China’s western Gansu Province to Kashgar and onto Tashkent in June last year.

To conclude, Kyrgyzstan has become an ideal service hub in Central Asia. Its exports are estimated to be worth about US$2 billion, and include gold, cotton, wool, garments, meat, mercury, uranium, electricity, machinery and footwear.

It imports about US$4.5 billion worth of goods, including oil and gas, machinery and equipment, chemicals and foodstuff. Thus the flourishing national economy of Kyrgyzstan is a good omen for the BRI.

Moreover, the Kyrgyz economy has been among the more liberal and open among Central Asian countries.

It was the first Central Asian country to become a WTO member in 1998 and its trade share in GDP is the highest in the region.

Its flourishing cross-border trade with its large markets at Dordoi and Kara-Su, transshipping large volumes of goods: importing goods through both formal and informal trade systems, mainly from China, and re-exporting (in few cases with some value-addition) to other regional economies are changing the economic landscape of the country.

Chinese BRI investment has now reached US$5 billion in Kyrgyzstan mainly in valuable manufacturing and transit projects.

In this connection, the Bishkek-Naryn-Torugart highway, the Bishkek-Osh highway, while an alternative road connecting the country’s north and south is currently under construction providing road links between Kazakhstan and Tajikistan. These are already the largest construction infrastructure projects in Kyrgyz history.

Appropriate fiscal tax, custom incentives, more business and investment friendly policies would further enhance its potential of trans-shipment and trans-trade.

Moreover, revisiting of its strategy of Special Economic Zones, further diversification of FDIs, rigorous commercial diplomacy, persuasion of green development, vast network of SMEs, micro-financing, digitalization and last but not the least development of qualitative human capital may be beneficial for the BRI as well as in the macro-economy of Kyrgyzstan.

Drastic improvement in the efficiency of the supply chain and transit, as well as the development of the transport sector would further foster the drivers of the competitiveness of the economy and integration into the world economy for the country.

There should be sincere efforts to realize its potential of becoming the transit and logistics hub in the region, a “bridge” between Europe and Asia.

The development of transport and logistics as the main factor of stimulating industrial growth and the development of the competitive economic system should be initiated.

The further integration of the regional transport systems and the development of the multimodal transport and efficient supply chains require an integrated approach to the development of transport services, infrastructure and logistics of Kyrgyzstan.