Washington

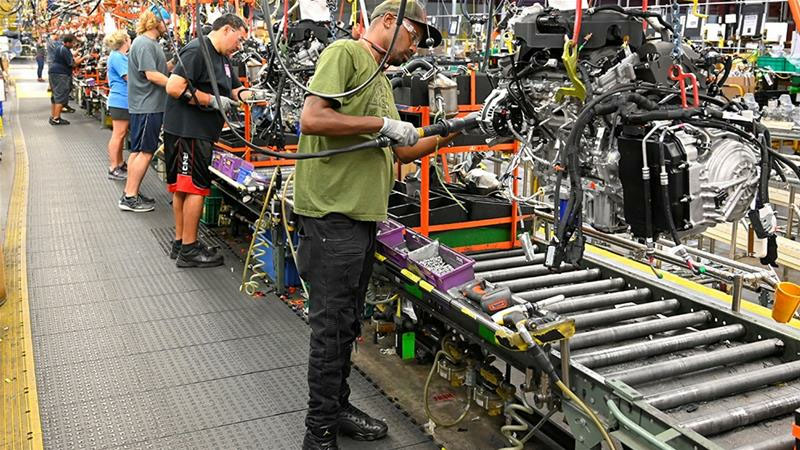

Economic activity in the U.S. manufacturing sector contracted for the third straight month in May amid mounting COVID-19 fallout, the Institute for Supply Management (ISM) reported.

The Purchasing Managers’ Index stood at 43.1 percent in May, up 1.6 percentage points from the April reading, which was the lowest level since April 2009.

Any reading below 50 percent indicates the manufacturing sector is generally contracting. “Three months into the manufacturing disruption caused by the coronavirus pandemic, comments from the panel were cautious regarding the near-term outlook,” Timothy Fiore, chair of the ISM’s manufacturing business survey committee, said in a statement.

Noting that the pandemic impacted all manufacturing sectors, Fiore said “May appears to be a transition month, as many panelists and their suppliers returned to work late in the month.”

“However, demand remains uncertain, likely impacting inventories, customer inventories, employment, imports and backlog of orders,” he said.

Among the six biggest industry sectors, Food, Beverage & Tobacco Products remains the only industry in expansion, according to the report. Transportation Equipment, Petroleum & Coal Products, and Fabricated Metal Products continue to contract at “strong levels,” Fiore said.

Despite the continued contraction, Tim Quinlan, a senior economist at Wells Fargo Securities, wrote in an analysis that “a reading of 43.1 in May versus 41.5 in April tells us that the pace of decline is slowing.”

“After some of the worst months on record, this is a step in a better direction,” Quinlan said, while noting that “there are certainly challenges ahead.”

“Supply chain disruptions and implementation of new social-distancing protocols in factories and workshops not just in the United States, but around the world, likely mean that the recovery here will take longer than the quicker turnaround we expect to see in consumer spending,” he said.—Xinhua