Karachi: The foreign exchange reserves held by the State Bank of Pakistan (SBP) took another hit and fell by $753.5 million, a fall attributed “mainly to external debt repayments”.

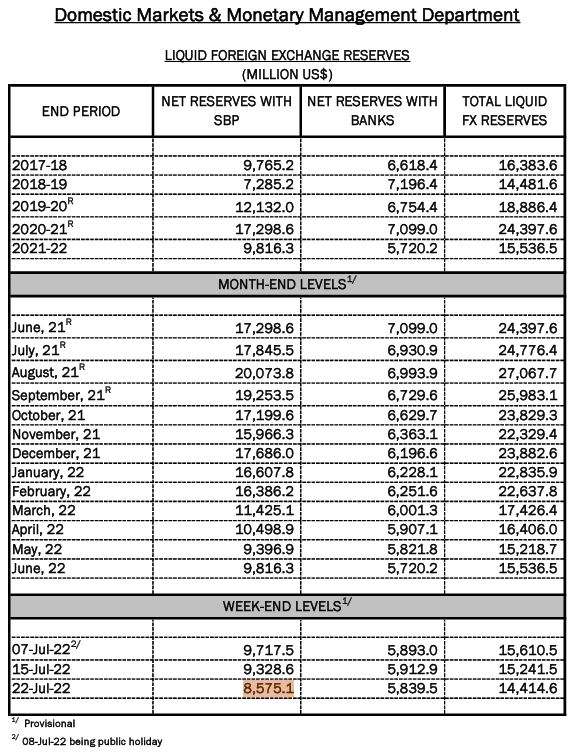

According to the data released by the central bank, as of July 22, the total reserves held by the country fell from $15.24 billion on July 15 to $14.41 billion on July 22.

While the net foreign reserves held by commercial banks amounted to $5.8 billion – witnessed a fall of $73 million during the week under review.

The reserves’ position is critical for Pakistan, which is desperately seeking dollar inflows to meet its balance-of-payments needs. A low level of reserves has also caused severe pressure on its currency and stock markets, with the rupee touching record lows throughout the ongoing week.

Pakistan’s Current Account Deficit crosses $17B mark during FY22

Pakistan’s current account deficit (CAD) crossed the $17 billion mark during the fiscal year 2022, a staggering 531% increase in the balance of payments compared to the imbalance of $2.8 billion recorded during FY21.

Read: Pakistan’s Current Account Deficit crosses $17B mark during FY22

According to a report published by the State Bank of Pakistan (SBP), the record imbalance in payment during FY22 is the highest since FY18, when it crossed $19.1 billion.

Since then, the annual CAD relatively started dropping, even though there was occasionally high CAD quarterly.

The report by the central bank also shows that the PML-N-led coalition government posted a CAD of $4.323bn in the April-June period of 2021-22, which was the second highest quarterly deficit of FY22.

In June alone, the CAD swelled to $2.27 billion compared to May’s $1.4 billion during the fiscal year that ended on June 30.

The State Bank said that this surge in current account deficit during June, despite higher exports and remittances, was due to a surge in oil imports. It said that 3.3 million metric tons of oil were imported in June, 33% higher than in May.