IDLC Finance Ltd, the largest non-bank financial institution in Bangladesh, is set to launch its Islamic financing window as it looks to tap business opportunities in a segment that is growing rapidly at home and abroad.

Yesterday, the non-bank said it had received the go-ahead from the central bank to introduce the Shariah-based financing operation.

The Shariah-compliant business will be run simultaneously with the existing operations, it said in a disclosure on the Dhaka Stock Exchange.

“Shariah-based financing business has a huge opportunity in Bangladesh, so we are entering the segment,” Masud Karim Majumder, group chief financial officer of IDLC Finance, told The Daily Star.

With this, IDLC Finance would make a foray into a banking segment that is growing at a steady pace in the Muslim-majority country.

Islamic finance bans interest payments, monetary speculation, gambling, short sales, and financing activities that it considers harmful to society. It can only be used to invest in Sharia-compliant assets or portfolios.

The $2.2 trillion global Islamic finance industry was expected to grow 10 per cent to 12 per cent over 2021-2022 due to increased Islamic bond issuance and a modest economic recovery in the main Islamic finance markets, S&P Global Ratings said in 2021.

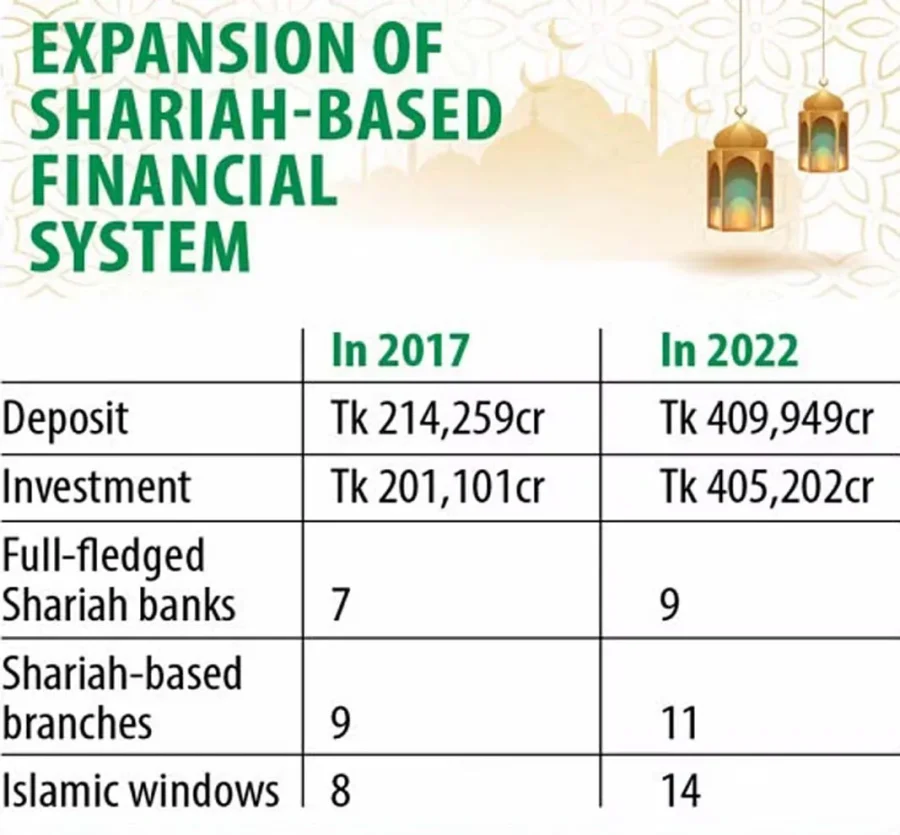

In Bangladesh, the market share of Islamic banks has increased in the total banking industry in the past one decade. At the end of December of 2022, Islamic banks represented 25.81 per cent share in terms of deposits and 29.20 per cent when it comes to investments, data from the Bangladesh Bank said. It was 23.13 per cent and 23.81 per cent, respectively, in 2017.

At present, nine banks have full-fledged Shariah-based operations and eleven banks have opened Shariah-based branches. Besides, 14 conventional banks have Islamic banking windows, according to the central bank’s latest quarterly report on Islamic banking.

In 2017, seven banks were full-fledged Islamic banks and nine banks had Shariah-based branches. Only eight banks had Islamic banking windows.

There are 35 NBFIs in the country. Of them, Islamic Finance and Investment, Hajj Finance and Aviva Finance have full-fledged Shariah-based operations.

“People have trust in IDLC Finance, but when we go to them, many don’t want to keep deposits with us since we run operations under the traditional system. Thanks to the new window, we will be able to cater to this group of customers,” Majumder said.

Total deposits in the Islamic banking segment stood at Tk 409,949 crore in 2022, up more than 91 per cent from Tk 214,259 crore in 2017, central bank data showed.

Investments (loans and advances) totalled Tk 405,202 crore at the end of 2022, up from Tk 201,101 crore five years ago.

A mid-level official of the central bank said that banks and NBFIs are launching Islamic windows or branches or turning into full-fledged banks or non-banks as most of the people in the country are Muslim and many of them don’t want to keep money with conventional banks.

“The Islamic financing system seems progressively attractive and profitable compared to conventional banks as the former gets the opportunity to maintain a lower statutory liquidity ratio (SLR) and a higher investment-deposit ratio (IDR).”

Traditional banks have to maintain a 13 per cent SLR, which is defined as the ratio of a bank’s liquid assets to a bank’s net demand and time liabilities, whereas it is 5.5 per cent for Islamic banks.

Similarly, the loan-deposit ratio for conventional banks is 87 per cent whereas the IDR is 90 per cent for Islamic banks.

Majumder said it is true that running a Shariah-based window, alongside a conventional operation, is challenging since a separate advisory board would be needed, separate products would have to be introduced, and different books would have to be maintained for the former.

“But we are confident about doing well. The Islamic finance system has witnessed phenomenal growth in Bangladesh in recent years and the momentum is expected to continue in the coming decades as well.”— The Daily Star