China’s foreign trade in goods has grown by a healthy 8.7% in January and February of 2024, according to a recent statement by the State Council. This flies in the face of some Western media reports suggesting an imminent Chinese economic collapse.

Even more impressive, exports surged by 10.3% compared to last year’s period, which already saw a significant increase due to the easing of COVID-19 restrictions. Imports also grew at a solid 6.7%.

The World Bank adds another layer to the story. They acknowledge that some US imports from China are shifting to other developing countries. However, these countries are often deeply integrated into China’s supply chains, suggesting a continued reliance on Chinese manufacturing infrastructure, particularly in strategic industries. In other words, displacing China entirely from the global export market will likely require further integration with, not a move away from, China’s vast production network.

Simply put, this means the global economy is now changing – for most of China’s modern economic growth history, that is, since opening and reform and indeed since the accession to the World Trade Organisation, the largest markets for China were the developed nations such as the USA which reduced this year by -7%, The European Union, another reduction of 6.8% and Japan which fell 2.5%.

Much of the EU Japan, and the UK are experiencing economic downturns, including what they can (or can’t) afford to buy from China. The US reports slight growth in its economy but has two problems; one is the increasing number of people falling out of the middle classes into low-income and even poverty; they can no longer afford to buy items they want; the other is the restrictions the US have imposed upon themselves to prevent them buying directly from China which create uncertainty for market stability.

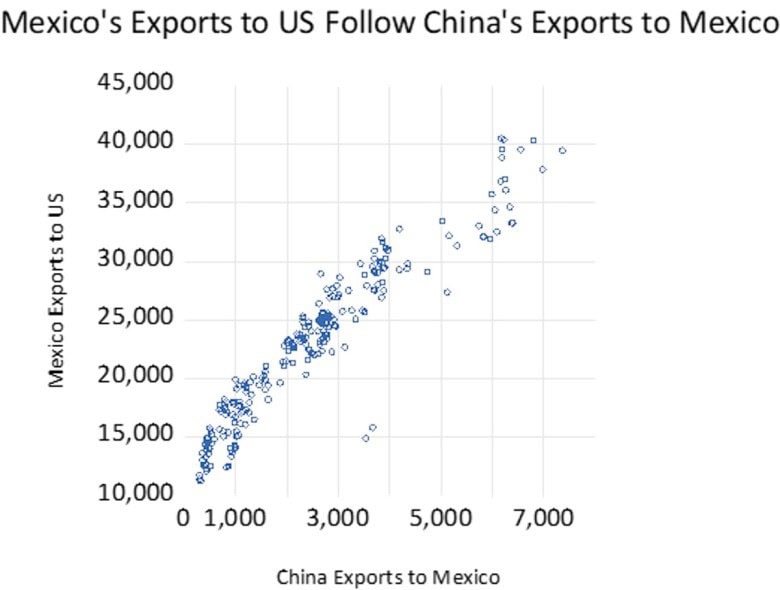

Nowhere is this more obvious than in the trade figures with Mexico. The Asia Times points this out with a stunning graph, clearly showing that China’s increases in exports to Mexico almost perfectly align with Mexico’s exports to the USA.

China’s largest trading partners are now all members of either ASEAN or BRICS. ASEAN consists of mainly developing countries, and all South East Asian and BRICS countries are based on emerging economies.

China’s trade with the places we know as the Third World or the Under-developed World has surpassed that of its trade with the Developed World, and this is not just good news. It is an epoch-changing moment in history: countries that have for centuries been mired in poverty, exploited by Western powers, colonised, and, in some cases, even had their populations enslaved are now rising the economic food chain.

Developed nations industrialised early, possess potent militaries, and, through that power, have enriched themselves through the resources of weaker lands. For several hundred years, weaker countries sought to benefit from plentiful resources and abundant local labour yet remained economically poor. The news China released earlier this week indicates that this is starting to change.

This is what the World Bank really means when its economists say, ” To displace China on the export side, countries must embrace China’s supply Chains.” Developing and underdeveloped nations are now taking a larger share of the profits from resources, products, and the labour required to make them.

For Consumers in developed nations, this means that if they want to buy products at their department stores, they might be able to avoid the Made in China label. Still, they can’t avoid the tag: “This product may contain components or materials from China.”

From a national security perspective, it’s already been highlighted that there will be a shortage of materials. These include titanium, tungsten, lithium and cobalt. These shortages can’t be filled locally as they don’t have the resources; they need to go to the places we have been calling the Global South to buy products from them. However, when they do, they will purchase many of these through processing plants built in China using Chinese loans. Shortages of materials to make ammunition for their weapons have been reported by Defense News in the USA, and the reason for that shortage is that they are reliant on China for many products.

For example, China produces 77% of the world’s cobalt, while the Democratic Republic of Congo controls a significant portion of the rest. The largest company mining cobalt in the DRC is Eurasian Resources Group, whose processing plant is a Belt and Road Initiative investment. The second largest producer is Tenke Fungurume, a Chinese-owned organisation.

China is building, or has built, ports in Africa; one report suggests that China has either a financial interest, an operational role or total control of as many as 63 ports throughout Africa. As Deborah Brautigam pointed out, this situation is not to entrap Africans into debt or gain control but to enhance mutually beneficial trade between Africa and China. It also ensures that if the Developed World wants to trade with Africa, they will almost certainly be doing so through ports that have at least some degree of influence or control from China and on ships that will almost certainly be built by China in the future because that’s another place where China is showing incredible growth – the profits of China’s significant shipbuilders increased by a stunning 131% last year as they upped orders and rose to number one of the world’s shipbuilding countries.

Every ship that leaves an African port with products bound for anywhere else in the world does so to the benefit of the country it leaves through export tax, shipping, handling, and transportation fees, which remain in the country as the products depart.

Asia and Africa aren’t the only places it’s happening, South and Central America, the Pacific Island Nations are all experiencing growth ins trade and strengthening relations with China.

This is good news for China and equally good news for much of the Developing World, but it must be a worrying sign that changes are needed to avoid a new term entering the lexicon: the Declining World.