Stretching the winning streak, stocks scaled new peaks on Tuesday, largely driven by expectations of a significant interest rate cut in the central bank’s monetary policy meeting scheduled for the first week of November amid renewed economic optimism.

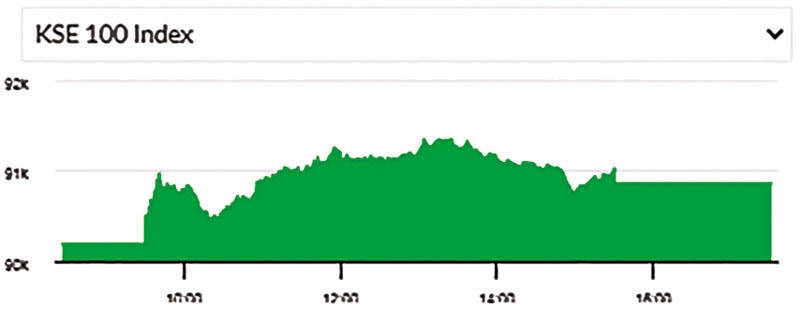

Pakistan Stock Exchange’s benchmark KSE-100 shares index gained 668.58 points to hit a record high of 90,864.09 points, after flirting with an intraday high of 91,358.15 points.

Brokerage Topline Securities in its market report said: “This rally highlights the market’s ongoing bullish momentum, fueled by robust corporate earnings that surpassed expectations, strengthening investor confidence.”

Institutional buying further propelled the rally, supporting the positive market sentiment, the brokerage report said.

“Trading activity remained strong, with 602 million shares exchanged, amounting to Rs 28 billion, while WorldCall Telecom led volumes with 41 million shares traded,” it added.

In a post market note, Ahsan Mehanti, senior analyst at Arif Habib Corp, said the market reached a new all-time high as investors weighed robust financial results and speculated over an imminent policy rate cut by the State Bank of Pakistan next week.

“Foreign interest in blue-chip banking and fertilisers, along with institutional buying amid easing lending rates, played a catalytic role in the record bullish activity at the PSX,” Mehanti added.

Index-heavy stocks, including Habib Bank Limited, MCB Bank Limited, Meezan Bank Limited, Pakistan Petroleum Limited, Pakistan State Oil, Sui Northern Gas Pipelines Limited, and Sui Southern Gas Company, led the rally.