Zubair Yaqoob

Karachi

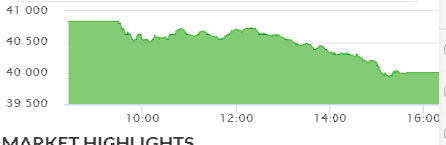

Market took a significant toll from the internal and external headwinds faced these days. During MoC, index decline crossed -900pts, which built up throughout the day. Market closed -825pts and closed the session with 274 stocks in decline. Selling was observed across the board, but was particularly seen in oil & gas chain. PPL’s most anticipated discovery proved to be a miniscule one that dampened the investor sentiment. Resultantly, PPL traded near lower circuits by the end of session. Cement sector led the volumes with 26.6M shares, followed by Technology (23.1M) and O&GMCs (22.7M). Among scrips, WTL traded the most with 13.6M shares, followed by HASCOLR (12.7M) and UNITY (11.9M). The Index closed at 40,008pts as against 40,833pts showing a decline of 825pts (-2% DoD). Sectors contributing to the performance include Banks (-225pts), E&P (-174pts), Power (-71pts), Fertilizer (-66pts) and Inv Banks (-56pts). Volumes declined from 180.7mn shares to 179.1mn shares (-1% DoD). Average traded value however, declined by 19% to reach US$ 44.9mn as against US$ 55.1mn. Stocks that contributed significantly to the volumes include WTL, HASCOLR1, UNITY, FFL and FCCL, which formed 31% of total volumes. Stocks that contributed positively include NESTLE (+9pts), INDU (+5pts), DGKC (+3pts), GHGL (+1pts) and INIL (+0pts). Stocks that contributed negatively include HBL (-93pts), PPL (-91pts), HUBC (-54pts), DAWH (-51pts), and OGDC (-49pts).