If the government finds a 1000 billion

AT this time when the government has presented the budget, every institution and individual has got his share, what can the government do if it suddenly finds 1,000 billion? Surely there can be no better news for the government than this.

Government has allocated 23 billion for Diamer-Bhasha Dam which actually needs much higher investment. A 100 billion for this project will be a serious start.

Taxes worth 100 billion on basic necessities can be reduced to fight the rising inflation.

The government employees have got a rise in salaries and a bonus worth 15 billion on the forthcoming Eid would be a great pleasure for them.

With 150 billion, allocations for health, primary and higher education can be made better.

Petrol is very heavily taxed and as calculated by Asad Umer, its price should be about 50 rupees.

A rebate of 100 billion on petrol would provide big relief and will also reduce the aggregate inflation.

With 150 billion, one mega project in every district can be started to create employment opportunities at the grassroots’ level.

A 50 billion in Ehsas Programme will enhance the coverage and amount of relief and a 35 billion would be sufficient for health insurance under Sehat Insaf Card.

After all this, a lot of money would be left out which can be given to the provincial governments to provide similar relief to their people.

But the question is, from where can the Government manage such a treasure? Let me find the source for the government.

Slash the policy rate to 3%, it will create a space of 1000 billion. For the payment of interest on domestic debt, the government has allocated 2.75 trillion, whereas interest on the same amount in the US would count to 100 billion only.

A reduction of 1% in policy rate can save about 250 billion of the national exchequers.

Actually, the interest rate (policy rate) that the government herself chooses, applies to public debt.

Presently, the interest rate in Pakistan is higher than all SAARC countries and is one of the highest in the world.

After the pandemic, all major economies slashed their interest rate e.g. the UK reduced it from 0.7% to 0.1%.

Pakistan also reduced the policy rate from 13.25% to 7%, but despite this reduction, the current interest rate in Pakistan is 70 times higher than that of the UK and 28 times higher than the US.

The question arises, when the government is authorized to choose policy rate, what motivated her to keep it at such a high level? The SBP decides the interest rates, and in its monetary policy statements, SBP presents inflations the major reason for choice of policy rate.

Therefore, the mark-up payments on public debt are not the cost of borrowing, but the cost of controlling inflation. If we decide not to pay this inflation control fee, we can do all the things mentioned above.

According to mainstream economic theory, when interest rate increases, people postpone their spending on durable goods, hence, the aggregate demand goes down leading to reduced inflation.

Therefore, many central banks choose to raise interest rate to cut inflation down. But Pakistani data provides evidence against this theory.

In 2018, interest rate was about 6% and the inflation was less than 6%. In June 2019, the interest rate went up to 13.25% and the inflation also increased to above 12%. Inflation reduced into single digit only after the fall in policy rate during march-June 2020.

This means, high interest rate is actually associated with high inflation. This means increase in interest rate lead to higher inflation.

Actually, when interest rate increases, the amount of markup payable on the government loans also increases and the government needs to increase taxes to finance these payments, and this causes higher inflation.

In April 2019, the domestic public debt was about 16400 billion and the government reserved 1391 billion for the markup payments.

A year later in 2019, the debt increased to 18200 billion and the government reserved 2531 billion for the markup. During one year, the debt increased by 14%and the markup payments by 82%.

This disproportionate change occurred due to change in policy rate. The PTI government after taking charge increased the policy rate and consequently, the markup payments also increased. At markup rate of 2018, only 1590 billion were sufficient for markup payment.

This means, the cost of this policy rate hike was 960 billion which enhanced the need to raise taxes resulting in increased inflation.

In the next year, policy rate was reduced due to pandemic and a 25% rise in domestic debt caused markup payment to increase by 4% only.

This implies the markup payments, the largest expenditure in federal budget depend on SBP choice.

The policy rate is kept high to reduce inflation, but the history shows this policy failed to reduce inflation.

Therefore, it is needed to reduce policy rate to save a huge amount of the national exchequer.

The banks have invested 25 trillion in government debt instruments and it would be very tough for the banks to find any alternative investment opportunity.

Suppose the banks withdraw one trillion from government securities, they would need to find alternate investment opportunities which will boost business.

In fact, with a policy rate of 3%, the business loans could be provided at 6-7% and the diverted amount with cheap markup will become an across-the-board employment scheme.

Furthermore, the businesses financed by banks are essentially documented and would become a continuous source of tax revenue.

Entire world adapted similar strategy to boost the economy. For example, Italy witnessed an 18% loss in GDP in the first half of 2020 and to cope with the crisis, Italy provided loan guarantees worth €400 billion.

The government guaranteed for repayment in case of default, so that the banks can finance businesses without worrying about default.

This was besides the fiscal stimulus of €300 billion provided as a direct support to the people of Italy.

Therefore, within the currently available resources, many initiatives of extreme importance are possible, if one reform is introduced ie reduction of policy rate to make it closer to the policy rate chosen by other countries of the world.

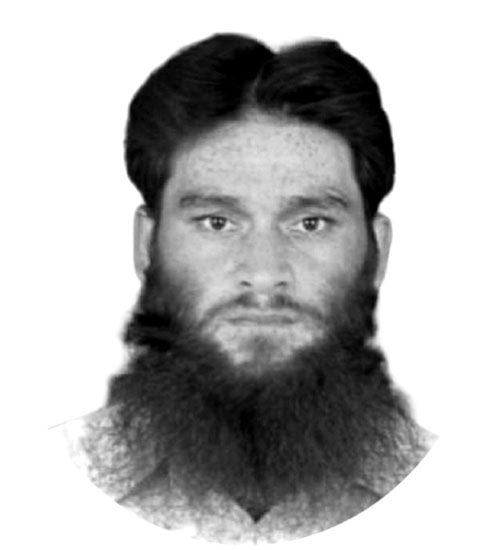

—The writer is Director, Kashmir Institute of Economics, Azad Jammu and Kashmir University.