ISLAMABAD – The Central Directorate of National Savings offers an attractive profit to Pakistani citizens on investment in Defence Savings Certificate.

The Defence Savings Certificates were rolled out by the government with an aim to help long term investors cater their financial needs.

The National Savings offers maturity plan for these certificates for the period of up to 10 years so investors can earn handsome profit on their savings.

The National Savings announced new profit rate for Defence Savings Certificates in December 2024 and it is applicable until next revision.

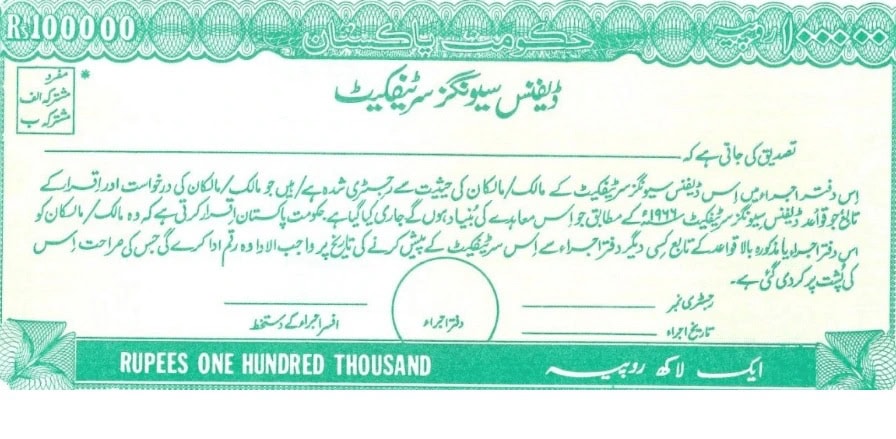

Both Pakistani nationals and overseas Pakistanis can invest in the Defence Savings Certificates. These certificates have a maturity period of 10 years and come in denominations of Rs.500, Rs.1,000, Rs.5,000, Rs.10,000, Rs.50,000, Rs.100,000, Rs.500,000, and Rs.1,000,000.

Defence Savings Certificates Profit Update

The profit rate for Defence Savings Certificates stands at 12.19 percent. Following are the profits on completion of every year until 10 years maturity on investment of 100,000:

First Year Rs109,000

Second Year Rs119,000

Third Year Rs130,000

Fourth Year Rs143,000

Fifth Year Rs159,000

Sixth Year Rs179,000

Seventh Year Rs204,000

Eighth Year Rs235,000

Ninth Year Rs272,000

Tenth Year Rs316,000

Tax/Zakat Deduction

The taxes and Zakat are deducted on the profits in line with the policy of the State Bank of Pakistan. The withholding tax for filers has been fixed at 15 percent while it is 30 percent for non-fielders.

Behbood Savings Certificates monthly profit rate in Pakistan for December 2024