Zubair Yaqoob

Karachi

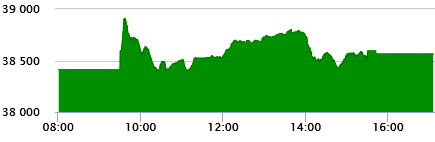

Market moved up and down during the session. Initially the index gained +500pts but erased all the gains on profit booking, which took the index -18pts. Activity picked pace again with index gaining again ~+350pts. MoC resulted in selling pressure again, closing the index +153pts (unadjusted). Key stocks that sustained selling pressure included DGKC, MLCF, FCCL and largely Steel sector, where MUGHAL saw trading at lower circuit. Among Fertilizer sector, ENGRO made a recent high close to Rs. 345, but faced selling pressure to bring the price to Rs. 338. Trading volumes registered at 385M shares, out of which Cement Sector led the table with 53.2M shares, followed by Banks (40.1M) and Power (38.5M). Among scrips, KEL realized volumes of 27.5M, followed by BOP (25M) and DSL (22.3M). The Index closed at 38,564pts as against 38,412pts showing an increase of +153pts (+0.4% DoD). Sectors contributing to the performance include Power (+103pts), O&GMCs (+63pts), Inv Banks (+37pts), Pharma (+28pts), Tobacco (-34pts) Banks (-31pts) and Fertilizer (-16pts). Volumes posted a decline from 466.1mn shares to 384.8mn shares (-17% DoD). Average trading value also declined by 9% to reach US$ 90.4mn as against US$ 99.8mn. Stocks that contributed significantly to the volumes include KEL, BOP, DSL, SNGP and PAEL, which formed 27% of total volumes.