Karachi

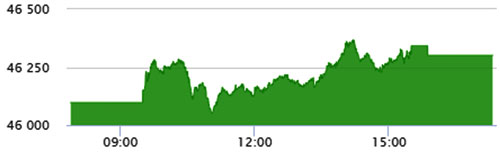

The expected growth-centric budget and relatively smaller current account deficit kept the Pakistan Stock Exchange (PSX) bullish on Tuesday and the benchmark KSE-100 Index gained 203.55 points (+0.44 percent) to close at 46,300.66 points.

The market opened on a positive note and the KSE-100 Index traded in a range of 320.3 points, showing an intraday high of 46,369.1 and a low of 46,048.8. Among other indices, the KSE All Share Index gained 49.47 points (+0.16 percent) to close at 31,248.84 points, while All Share Islamic Index gained 15.17 points (+0.07 percent) to close at 22,546.4 points.

A total of 418 companies traded shares in the stock exchange, out of them shares of 232 closed up, shares of 169 closed down while shares of 17 companies remained unchanged.

The overall market volumes decreased by 89.26 million to 677.38 million shares, while market capitalisation increased by Rs12.68 billion. The number of total trades decreased by 42 to 176,976, and value traded increased by Rs3.57 billion to Rs23.51.

Among scrips, WTL led the table with 149.5 million shares, followed by UNITY (66.8 million) and TELE (37.6 million). Stocks that contributed significantly to the volumes include WTL, UNITY, TELE, HUMNL and BYCO, which formed 46 percent of total volumes.

The sectors propping up the index were commercial banks with 155 points, cement with 39 points, food & personal care products with 32 points, fertilizer with 18 points and textile composite with 17 points.—TLTP