Zubair Qureshi

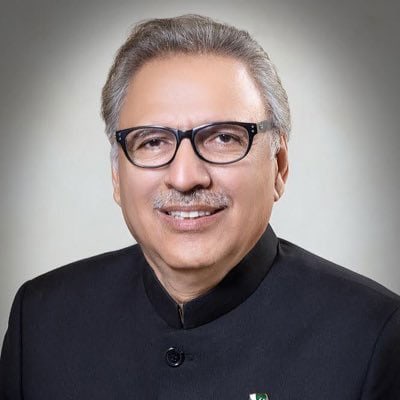

President Dr Arif Alvi has upheld the decision of the Banking Mohtasib directing a private bank to credit the lost amount of Rs 800,000 (eight hundred thousand rupees) to the account of bank fraud victim.

While rejecting the representation of the bank against the decision of the Mohtasib, the president observed that the bank was at fault for having incorporated the wrong contact numbers of the account holder in the bank system, thereby, preventing the complainant from taking any remedial step to avert the loss after receiving SMS alerts about the fraudulent transactions.

As per the details, Ms Naveera (the complainant) had been maintaining an account with Muslim Commercial Bank Gulshan-e-Ravi Branch, Lahore.

She had to lose her money after her account was debited by using an ATM Card at four different ATM terminals.

She claimed that those transactions were unauthorized as those had not been conducted by her and the ATM Card was throughout in her possession.

The Banking Mohtasib in its decision observed that additional contact numbers of the complainant had been added in the bank’s record without any authorization from the account holder, therefore, SMS regarding cash withdrawal transactions could not be received by the complainant.

Moreover, the bank had changed her PIN Code on 21.01.2019, just three days before the transactions, after receiving a phone call from an imposter as the Phone Banking Officer did not probe the caller. The bank admitted during the hearing that the voice of the caller was different from the voice of the lady complainant.

The Ombudsman, therefore, ordered the bank to make good the loss by crediting the account of the complainant with a sum of Rs 800,000.

Later, the bank filed a representation with the Honorable President, which he rejected observing that the bank miserably failed to fulfil its statutory liability and rebut the claim of the complainant by failing to provide any justification to set aside the orders of the Banking Ombudsman.