Zubair Yaqoob

Karachi

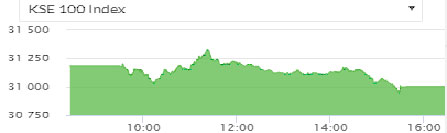

Market initially went down by 147pts and reverted the loss by ~+300pts to post gain of 149pts. However, the session ended in bearish territory at -183pts (unadjusted). Carrying the trend from Monday, HUBC kept falling that reflected the pressure on Index amongst other scrips such as HBL, UBL, PSO, MCB, NBP.

Volumes remained low at 54M shares. Cement sector led the volumes table with 7.7M shares, followed by Power (5.9M) and Technology (4.7M). MLCF ranked first amongst volume leaders with 4.8M shares, followed by KEL (3.1M) and HUBC (2.4M). The Index closed at 31,001pts as against 31,181pts showing a decline of 180pts (-0.6% DoD). Sectors contributing to the performance include Banks (-94pts), Power (-37pts), Chemical (-18pts), O&GMCs (-17pts), Autos (-12pts) and Fertilizer (+26pts). Volumes increased slightly from 52mn shares to 54.3mn shares (+4% DoD). Average traded value on the contrary jumped by 49% to reach US$ 16.8mn as against US$ 11.2mn. Stocks that contributed significantly to the volumes include MLCF, KEL, HUBC, TRG and FFC, which formed 27% of total volumes. Stocks that contributed positively include FFC (+19pts), POL (+11pts), DAWH (+10pts), HBL (+6pts) and GHGL (+5pts). Stocks that contributed negatively include UBL (-38pts), MCB (-37pts), HUBC (-26pts), COLG (-12pts) and THALL (-10pts).