BRI and Strategic Role of Chongqing: An Expert Opinion

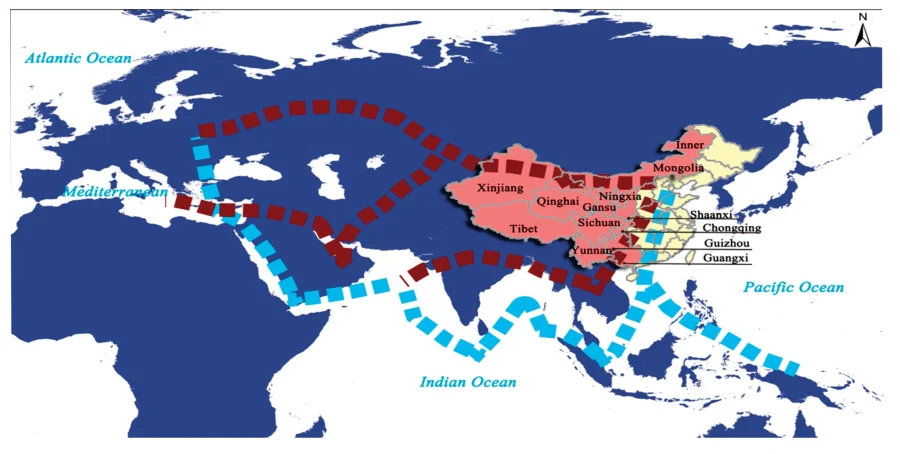

The Chinese Belt and Road Initiative (BRI) has entered into its 10th year during which it has become an icon of success, services, connectivity, integration of socio-economic prosperity, infrastructure development and eradication of poverty among the member countries.

The BRI has institutionalized new concepts of bilateral and trilateral relations in terms of economic, transport, digitalization and financial corridors in which some cities can increase economic growth and participate in global economic flows by acting as hubs or gateways to regional corridor. In this regard, the Chinese city Chongqing stands out for its well-developed infrastructure and digital connectivity in the further development of the BRI.

Interestingly, Chongqing’s transportation network has reached global city standards and is on par with entire countries such as the United Kingdom or Republic of Korea or Singapore. Chongqing has developed a world-class transportation system with five forms of connectivity: highway, subway, rail, port and air. It has enabled the city to become a major gateway and transport hub for inland China contributing in the further development of the BRI. Obviously, it has also a strategic importance for the BRI, connecting the growing economies of South Asia and Southeast Asia with the rest of China. The Southern Transport Corridor, a new trade route between western China and Southeast Asia, is one of the most important projects within the Chongqing Connectivity Initiative (CCI) initiated by Chongqing and Singapore.

According to official figures, in 2016, the city had direct flights to 158 cities and connections to 258 cities, and it also started direct flights to London, Dubai, Tokyo and other international destinations. Chongqing’s ports have the potential to contribute more to its economic growth. Its maritime logistics chain between the city and Shanghai has become a value addition.

Multimodal linkage with rail connections to Europe, rather than the traditional maritime route through Shanghai, is the optimal way to develop Chongqing’s ports. The new Guoyuan Port will stretch for 2,800 meters and have 16 piers. Its direct connection to the Chongqing-Xinjiang-Europe railway will allow container traffic between Chongqing and downstream towns along the Yangtze River as well as shipping by barge to Chongqing and Europe, and reduce the transit time to Shanghai.

Furthermore, Chongqing’s massive investment in its transportation network has strengthened the city’s strategic position as a gateway for inland China. It has now become an international hub and a base for the ASEAN region, which should be further, developed its connectivity and better leverages its transport network to promote economic integration.

Additionally, the China-Europe freight train service was initiated in 2011 which has now become a significant part of the BRI stimulating trade between China and economies of the its member countries.

According to official statistical data, China’s five freight assembly hubs Zhengzhou, Chongqing, Chengdu, Xi’an and Urumqi had 4,003 trains with 40 and 50 carriages, accounting for 78.15 percent of the total dispatched trains in more than 50 cities in China where China-Europe freight trains operate.

The National Development and Reform Commission said that China has allocated 200 million Yuan ($28.3 million) from the central budget to support the construction of transportation hubs in these five cities. The work is being undertaken to improve the efficiency of the transportation network for the China-Russia and China-Europe freight train services.

Across China, multiple China-Europe freight trains from different Chinese cities have made their maiden journey in 2023. On January 1, a China-Europe freight train left a station in Southwest China’s Chongqing Municipality and was scheduled to arrive in Duisburg, Germany in about 15 days.

The China-Europe freight train sets to usher in a critical stage of “explosive growth,” and China’s reopening, the accelerated implementation of BRI projects, and deepened trade ties with Asian and European economies will all fuel the momentum.

In this connection, over the last three years, China-Europe freight trains have earned the reputation of “a passage of life when sea and air transportation were crippled by the pandemic. It has been dubbed a “Steel Camel” in the strategic expansion and connectivity of the BRI.

More than 109,000 tons of anti-pandemic products have been sent to Europe through the trains till today along with auto parts, electronic products, and raw materials, effectively guaranteeing the stability of international industrial and supply chains.

To conclude, the train has created a new passage between China, Central Asia, East Asia, Southeast Asia, and the European continent. It is also building a new landscape in global trade that will lead to win-win cooperation with countries and regions along the BRI.

Hopefully, during 2023 the China-Europe freight trains will further open up more markets and deepen China’s trade ties with BRI countries. More importantly, the train, a vivid display of China’s commitment to globalization and opening-up, will push against the decoupling rhetoric of certain Western counties, connect the world better, and encourage more countries to actively engage in the talks of free trade and new rules of engagement.

Running through Asia and Europe, China-Europe freight trains have been boosting trade between countries and regions involving in the BRI. As of January, China-Europe freight trains with 78 routes planned have reached 180 cities in 23 European countries, significantly facilitating the trade between China and the Belt and Road (B&R) countries.

The operation efficiency of the trains has been greatly improved over the past few years. Statistics showed that the total transit time was shortened from 24 days in the very beginning to 12 days.

80 percent of China’s exports to Europe three years ago were electronic products, mechanical products and automobile parts. In the first half of 2021, these three types of commodities accounted for only about 40 percent of the total goods transported, while the share of chemical products like plastics, rubber and glass increased rapidly. The transportation volume of medical and health products also showed a growth momentum.