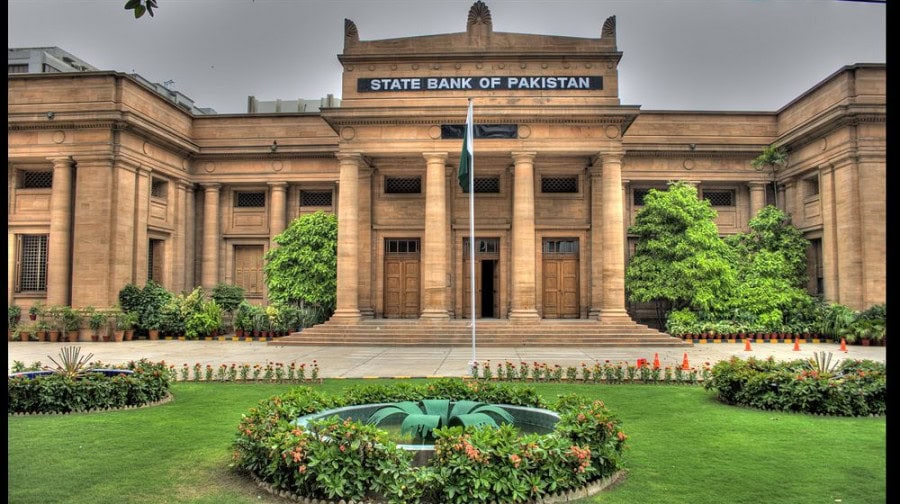

Staff Reporter Karachi

The Financial Stability Review (FSR) for CY20 issued by State Bank of Pakistan on Wednesday indicated mild impacts of Covid-19 on national economy while financial system with over 14 percent expansion in asset base-exhibited resilience in a challenging environment.

The FSR highlights that Calendar Year 2020 was a challenging year for the financial sector as Covid-19 pandemic triggered deepest global recession since the Great Depression but in case of Pakistan, impact of corona virus waves has been relatively mild as the output loss of 0.47 percent for FY20 was one of the lowest among Emerging Market and Developing Economies.

SBP’s relief measures coupled with fiscal stimulus provided by the Government, extended necessary support to households and businesses, which led to revival of the economy as reflected in estimated GDP growth of 3.94 percent for FY21, the review noted.

The FSR is SBP’s flagship annual publication that presents performance and risk assessment of various stakeholders in the financial sector including banks, non-banking financial institutions, financial markets, non-financial corporates and financial market infrastructures.

Besides enormous loss of lives worldwide due to this health crisis of epic proportions, economic activities were severely disrupted.

To mitigate the adverse implications, national authorities and central banks around the globe swiftly enacted supportive policy measures—at an unprecedented scale—to preserve financial and economic resilience, it said.

The economic stress subsided in the second half of 2020 and on wards due to the revival of economic activity in response to swift and comprehensive policy measures taken, receding intensity of infections, and easing of mobility restrictions.

The Review noted that the financial system of Pakistan exhibited resilience and continued to perform its operations in a challenging environment.

The asset base of the sector expanded by 14.08 percent in CY20 in comparison to 11.61 percent growth in the previous year. The major contribution in this growth came from the banking sector, the largest segment of the financial sector.

Financial markets, after experiencing a short-lived bout of volatility, regained confidence in the second half of the year owing to timely interventions by SBP.

The banking sector showed marked performance and resilience. The sector posted a strong growth of 14.24 percent in its asset base supported by a decent growth in deposits, a major source of funding. Within the asset mix, investments in Government securities outgrew the private sector advances.

The growth momentum for the latter remained subdued due to the pandemic induced slowdown and weak demand for credit.

The sector experienced a moderate rise in credit risk in the first half of 2020, which subsided in the second half, among others, as a result of SBP’s regulatory relief measures.

Importantly, with a revival in economic activity, corporate sector’s performance and repayment capacity improved which further subsided the credit risk concerns.

The earnings of the banks increased substantially owing to lower interest and administrative expenses as well as gains on sale of securities.

Strong earnings, in turn, enhanced the solvency of the banking sector, as capital adequacy ratio increased by 156 basis points to 18.56 percent at the end of CY20 – well above the minimum regulatory requirement of 11.5 percent.

Stress test results of the banking sector also show that, even against adverse economic conditions, the banking sector is likely to maintain resilience over a three-year projection horizon.

The FSR mentions that the performance of Islamic Banking Institutions (IBIs) was notable as their asset base expanded by 30 percent during CY20 due to decent growth in financing and a surge in investments.

Encouragingly, availability of additional Shariah-compliant investment avenues facilitated IBIs to improve their liquidity profile.